A total of five stocks traded under the Z category secured positions in the DSE top gainers list.

High-risk stocks witnessing an unexpected price surge in a bearish market have left analysts scrambling for answers, with some insiders pointing to potential manipulation by bad actors and regulatory gaps.

For instance, shares of Bangladesh Industrial Finance Company (BIFC), a non-bank financial institution nearing collapse, surged by over 46% last week on the Dhaka Stock Exchange (DSE), reaching a 20-month high despite the lack of any substantive information to justify the unusual price increase.

Despite the company struggling with over 99% non-performing loans, its shares closed at Tk12 at the end of last week's trading session, up from Tk8.20 at the beginning of the week.

Following BIFC, other loss-making companies such as Global Heavy Chemicals, Khulna Printing and Packaging, First Finance, and Tung Hai Knitting also appeared on the gainers' list last week.

Including these companies, a total of five stocks traded under the Z category secured positions in the top gainers list.

In the DSE's top 10 gainers list, only two companies and one mutual fund from the A category managed to secure positions.

A managing director of a brokerage firm, on condition of anonymity, told TBS that last week's performance indicates the market is being influenced by manipulators.

"In recent days, they [bad actors] have been targeting junk stocks to manipulate shares. This trend continues as the securities regulator has failed to send a strong enough message to deter such unscrupulous players," he added.

The Bangladesh Securities and Exchange Commission (BSEC) frequently intervenes in the market by imposing floor prices to halt price declines and ensure investor security. However, it also disrupts the market's natural rhythm and ultimately fails to restore investor confidence. Instead, such interventions tend to exacerbate market volatility, he added.

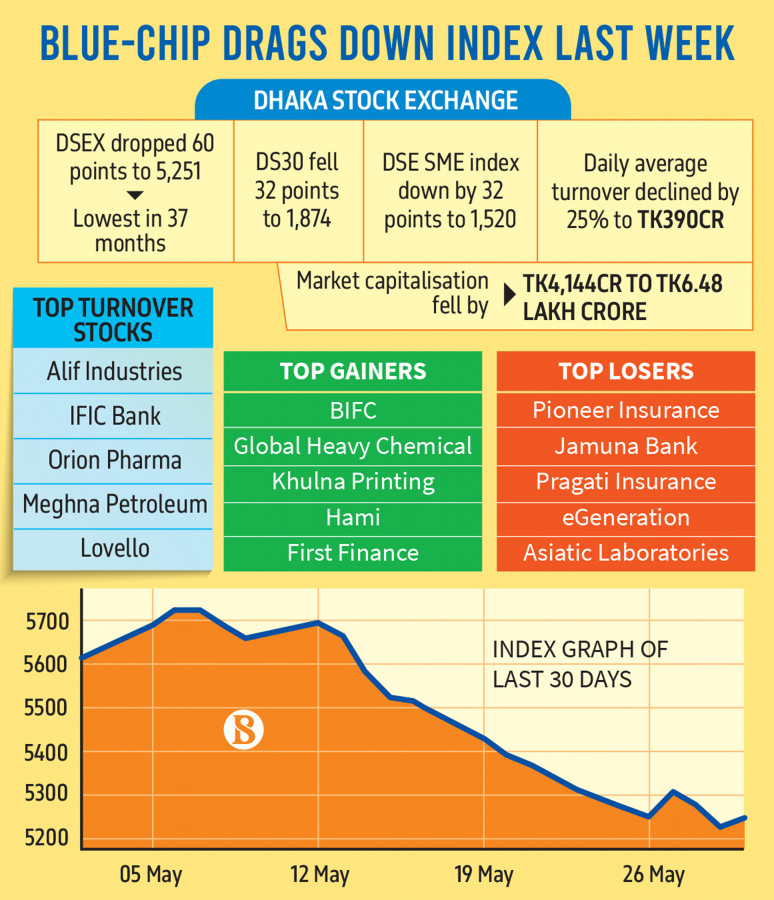

Meanwhile, DSEX, the broad index of DSE, plunged by 60 points to settle at 5,251 points last week, the lowest in 37 months. Blue-chip stocks mainly played a pivotal role in dragging down the index.

EBL Securities said in its weekly market review that the relentless bearish spell extended in the capital bourse market for three consecutive weeks as investors opted to reduce their capital market exposure amid the prolonged bearish sentiment regarding the market's momentum intensified by the pre-budget concerns.

Despite the media reports on the prime minister's order to form a committee to address recent capital market issues, market sentiment has yet to rebound due to the absence of any major positive triggers, which led the market to witness lacklustre momentum throughout the week, allowing the bears to firm their control across the trading floor, it added.

Beacon Pharma, Khan Brothers, Jamuna Bank, BRAC Bank, Premier Bank and Renata played a key role in dragging down the index last week.

Pioneer Insurance emerged as the worst performer last week, with its shares plummeting over 19% to settle at Tk48.60. This decline was primarily attributed to the share dilution required to adjust for the stock dividend after the record date.

The other losers are — Jamuna Bank, Pragati Insurance, eGeneration and Asiatic Laboratories.

Meanwhile, investor participation in the market has also continued its declining trend as average turnover decreased by 25% to Tk390 crore as compared to Tk517 crore in the previous week.

Alif Industries was the top traded stock, followed by IFIC Bank, Orion Pharma and Meghna Petroleum.

Investors were mostly active in the pharmaceutical sector, followed by the textile and food sectors.

Most of the sectors ended in red with the jute sector being the biggest loser, followed by IT, non-bank financial institutions, paper, tannery and engineering sectors.

Source : The Business Standard