Stocks bounced back in the outgoing week from a two-week losing streak, as bargain hunters put funds on selective small-cap shares, hoping to reap short-term gains.

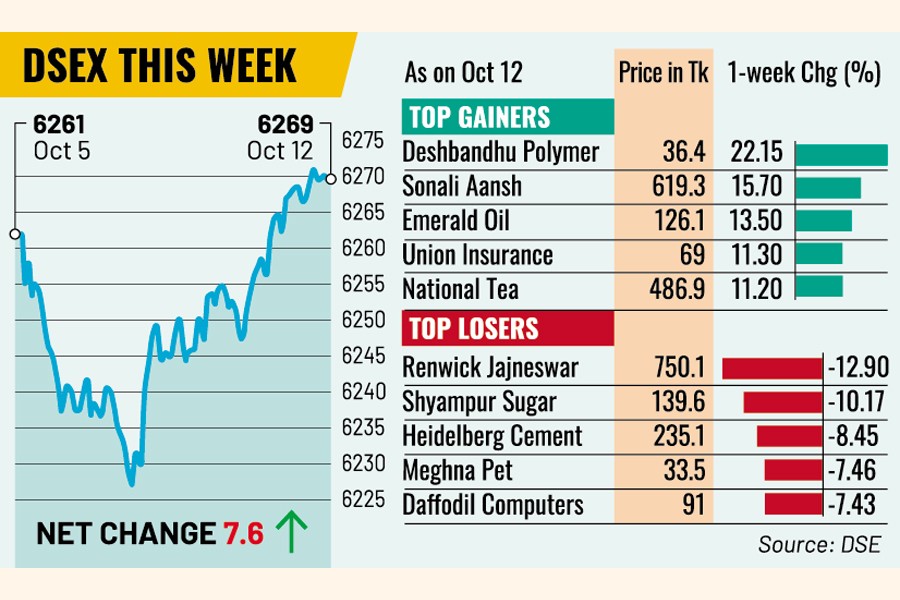

The investors continued to target low-cap stocks as many such companies, including Deshbandhu Polymer, Sonali Aansh Industries, Emerald Oil Industries, National Tea Company, Central Pharma, National Feed Mills and Fu-Wang Food, topped the gainer's table.

Simultaneously, some insurance companies regained momentum, with investors renewing their buying appetite for the beaten-down stocks.

Many investors found oversold insurance stocks lucrative for investment as the central bank hiked the interest rate, said a stockbroker.

"The higher interest generally helps increase the cash-surplus insurance industry's financial income," he said.

This week featured five trading days. Of them, the first two suffered losses while the last three sessions ended higher.

DSEX, the benchmark index of Dhaka Stocks Exchange (DSE), finally settled the week 7.63 points or 0.12 per cent higher at 6,269.35, after losing more than 48 points in the past two straight weeks.

Two other indices also managed to edge up. The DS30 Index, which consists of blue-chip companies, gained nearly 4 points to close at 2,141 and the DSES index, which represents Shariah-based companies, advanced more than 2 points to 1,358.

According to weekly analysis by EBL Securities, the recent downbeat vibe in the market has created lucrative investment opportunities for bargain hunters who were enticed by the allure of potential quick gains in particular beaten-down stocks.

The total turnover of the week stood at Tk 20.15 billion, down from Tk 23.36 billion in the week before.

The average daily turnover stood at Tk 4.03 billion in the outgoing week, which was 14 per cent lower than the previous week's average of Tk 4.67 billion.

The general insurance sector kept its dominance on the turnover list, capturing 22 per cent of the week's total turnover, followed by food (18 per cent) and travel & leisure (9 per cent).

Small-cap jute sector posted the highest gain of 11.6 per cent as Sonali Aansh Industries saw almost 16 per cent gain during the week, followed by travel & leisure, cement, tannery and food sectors.

Most of the traded stocks saw price erosion. Of 366 issues traded, 91 witnessed price fall and 56 saw price surge while 219 issues remained unchanged on the DSE trading floor.

Sea Pearl Beach Resorts was the most-traded stock with shares worth Tk 1.20 billion changing hands, followed by Fu-Wang Food, LafargeHolcim, Gemini Sea Food and Deshbandhu Polymer.

Deshbandhu Polymer remained the week's top gainer for the two consecutive weeks, rising 22.15 per cent further following its annual profit surge. In the past two weeks, its stock soared 54 per cent as the company reported a 26 per cent higher profit to Tk 36.21 million for FY23.

The state-run Renwick Jajneswar was the worst loser, shedding 12.89 per cent.

Most of the sectors saw price appreciation with the small-cap Jute sector posted the highest gain of 11.60 per cent.

The Chittagong Stock Exchange (CSE) also ended higher after two weeks, with the CSE All Share Price Index (CASPI) gaining 14 points to settle at 18,545 and the Selective Categories Index (CSCX) rising 8 points to 11,087.

The port city's bourse traded 28.96 million shares and mutual fund units with turnover value worth Tk 1.11 billion.

Source: The Financial Express

Note: This email is for research and analysis purposes only.