Equity indices on the bourses extended their decline on Monday as investors persistently liquidated their holdings, driven by uncertainties surrounding various economic factors and upcoming elections.

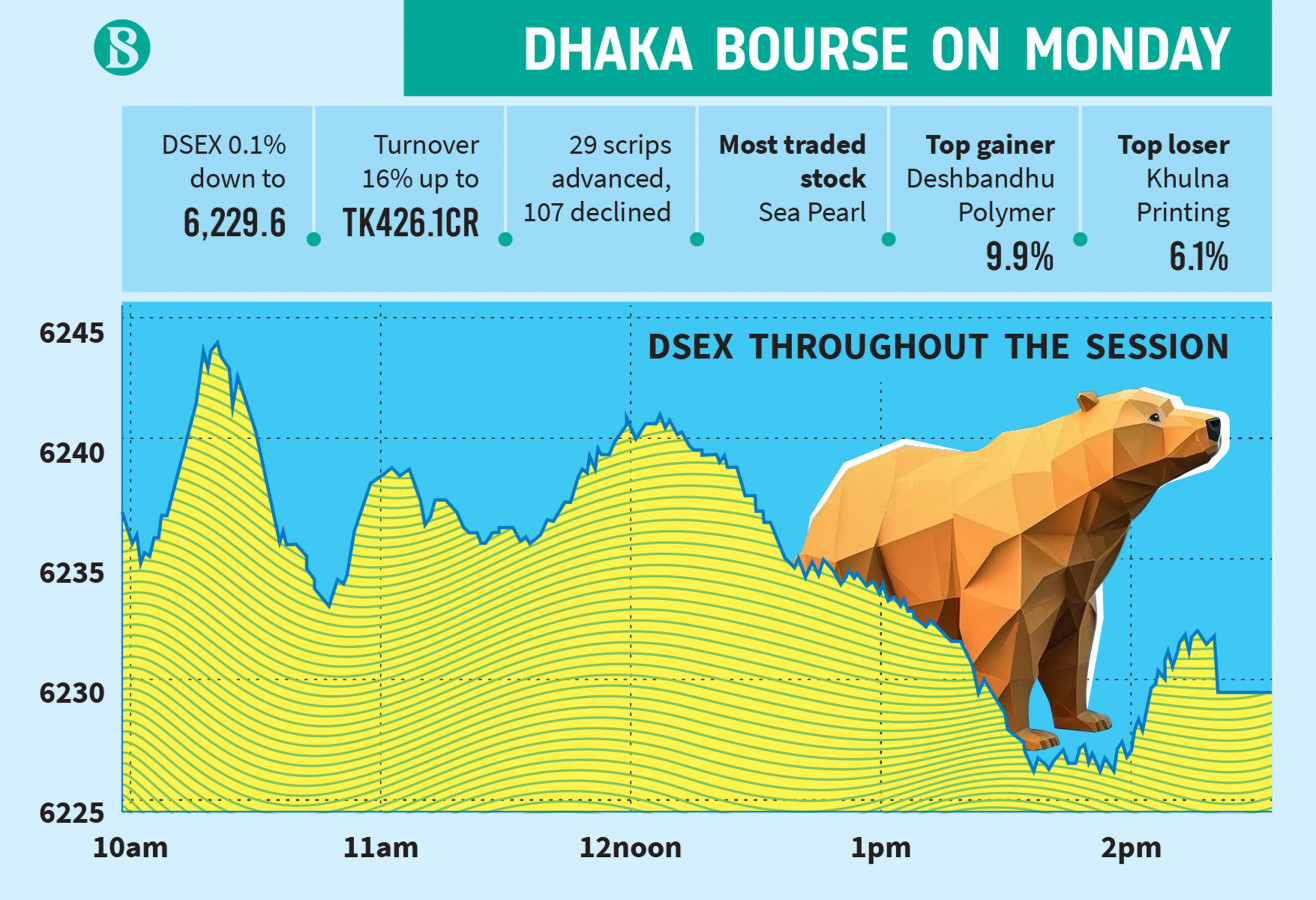

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), moved 33 points down in the last three sessions and stood at 6,229.6 on Monday.

The piling up of macroeconomic woes such as the shrinking reserve of the country, record-high defaulted loans, and declining remittances, is what eroded the investor confidence, according to market insiders.

Moreover, concerns persist regarding the non-disbursement of the IMF's second instalment due to the failure to meet specified conditions, further exacerbating market sentiment.

What's more, uncertainties about the upcoming national elections, central bank's recent tightening of the monetary policy, US visa sanctions, and a group of rumour-mongers disrupting the market stability are also the factors that weakened investor confidence and prompted them to engage in heavy selloffs, market insiders added.

In an event on Sunday, Professor Shibli-Rubayat Ul Islam, chairman of the Bangladesh Securities and Exchange Commission (BSEC) said the capital market is a sensitive place. Many people spread misleading information on social media platforms to earn money.

"We are going to be in trouble before the elections as many people intend to create volatility in the market ahead of the elections."

"There's a lot of anxiety at the beginning of each day's trade and also before we go to sleep at night as we ponder what will happen to the market the next day."

"We all have to collectively resist those who are giving fake news. We want to fix the market and move forward but when unrest starts, people will exit the market with their money," he added.

ATM Tarikuzzaman, managing director at the DSE told The Business Standard, "We are continuously alerting investors against rumour mongers. Investors should invest in the market based on their own decisions."

On Monday, investor participation slightly increased as the DSE turnover grew by 16% to Tk427 crore compared to the previous trading session.

On the sectoral front, banks contributed the highest 21% to the day's turnover, followed by travel adding 14.2%, and general insurance adding 11.8%.

Sea Pearl Beach resort was the most traded stock on the day, followed by LafargeHolcim and Square Pharma.

Only travel and jute exhibited positive returns with 1.5% and 0.2% gains respectively.

Paper saw the highest price correction of 1.8%, followed by IT losing 1.7%, and general insurance losing 1.3%.

Out of the 392 issues traded, 29 advanced, 106 declined and 257 remained unchanged on the DSE trading floor.

Deshbandhu Polymer was the top gainer whereas Khulna Printing was the top loser on Monday.

The port city bourse, Chittagong Stock Exchange, also settled on red terrain. The selected indices (CSCX) and All Share Price Index (CASPI) declined by 4.8 and 7.4 points to 11,041 and 18,470 respectively.

Source: The Business Standard

Note: This email is for research and analysis purposes only.