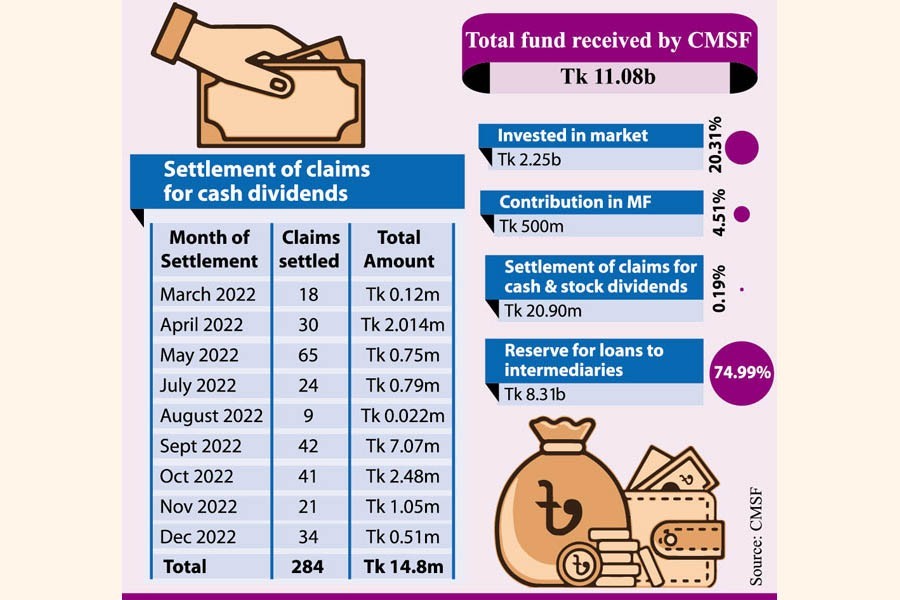

As stabilisation fund rolls out, investors reap benefits

Saif Imam Zamir in September last year received Tk 0.142 million in cash dividend after he had claimed returns yet to be paid by a company where his mother invested 29 years ago. As many as 283 more claims of...

Stocks open higher despite sell-offs

Eastern Housing shares soar after half yearly profit jumped by 19%

Marico posts 13% profit growth amid economic crisis

Economy

Capital machinery leads huge drop in LC opening

January 20, 2023

· The import of capital machinery in the July-December period of the current fiscal year stood at USD 1.27 billion, which was 65.32% less than imports involving USD 3.67 billion in the same period of FY22.

· Consumer goods and industrial raw materials worth USD 4.12 billion and USD 1.20 billion respectively were imported during the first half of the current fiscal year, which was USD 4.69 and USD 1.65 billion respectively in FY22.

· Bankers said foreign trade is in turmoil because of the Russia-Ukraine war. Foreign buyers' demand for importing garments from Bangladesh has decreased. At the same time, due to shortage of dollars in the country's banks, traders are not able to import goods despite the demand.

· In the July-December period of FY23, intermediate goods worth USD 2.58 billion were imported, which was 33.18% less than the imports worth USD 3.87 billion in the same period of the previous fiscal year.

From: https://www.tbsnews.net/economy/banking/capital-machinery-leads-huge-drop-lc-opening-571130

Dhaka witnesses 11.08pc inflation in 2022: CAB

January 22, 2023

· The general inflation in Dhaka city was recorded at 11.08 per cent in 2022 as rocketing prices of food and nonfood items badly affected the millions, according to a latest report.

· The Consumers Association of Bangladesh (CAB) prepared the report on annual inflationary pressure 2022 and published it on Saturday, revealing that food inflation was 10.03 per cent while non-food inflation was 12.32 per cent.

· CAB calculated the general inflation of low-income people separately which was much higher at 9.13 per cent.

· Food inflation for the low-income consumers was 10.03 per cent while it was 7.76 per cent for the nonfood items.

· According to the report, August 2022 was the costliest month as food inflation rose to 15.31 per cent.

· The costs of 141 food products, 49 nonfood items and 25 services between January 2022 and December 2022 were calculated to get the rate of inflation, CAB said.

Fund shortage, cost rise stall over 1,000 dev projects

January 22, 2023

· Global and local economic crises arising from the pandemic and the ongoing war in Europe that prompted the government to opt for austerity measures in the development sector have now stalled thousands of projects worth lakhs of crores of taka.

· Some 1,016 ongoing development projects involving around BDT 4,50,000 crore under seven government agencies are mired in delays reportedly for a number of reasons i.e. non-release of funds by the government, high prices of construction materials, no revision to schedule of rates, non-payment of outstanding bills to contractors, and problems in opening LCs to import construction materials amid the dollar shortage.

· According to sources involved in the projects, around 60% of these projects are now almost stalled.

From: https://www.tbsnews.net/economy/fund-crisis-cost-rise-stall-over-1000-dev-projects-571350

Payments cross taka 78,054b in quantum leap

January 22, 2023

· Aggregate digital payments in Bangladesh crossed BDT 78,054 billion in a nearly 37-percent growth year on year in the past fiscal, marking a quantum leap in the transition.

· People familiar with the development said that such banking got a shot in the arm during the covid-19 crisis period and now widened fast for being more convenient and cost-effective.

· A UN platform named 'Better Than Cash Alliance' in its latest report said Bangladesh's annual GDP would increase by 1.7 per cent once the payment system is made fully digital.

From: https://www.newagebd.net/article/192042/tk-12777cr-in-farm-loans-released-in-july-nov

Banking

Bad loan recovery drops 51% in Q3 2022

January 19, 2023

· "Loan recovery usually gets momentum in June and December. The rules were somewhat relaxed in July-September, the first quarter of FY23," a senior official of a private bank said.

· "Most of our loans are to industries that have been facing a crisis since the beginning of the Russia-Ukraine war in April last year. Their production decreased by 15-20%. As a result, many failed to repay bank [defaulted] loans in the quarter," he added.

· "The key reason behind the lower rate of loan recovery than the rate at which the defaulted loans are increasing is the relaxed repayment policy of the Bangladesh Bank," said Anis A Khan, former managing director of Mutual Trust Bank.

· "The relaxed policy is fine for some businessmen who are actual victims but some others are taking advantage of that. So, the amount of defaulted loans has been on the rise and the recovery on the decline."

From: https://www.tbsnews.net/economy/banking/bad-loan-recovery-drops-51-q3-2022-570510

note: this post is for research and analysis only