Finance Minister AH Mahmood Ali, while presenting the budget in parliament, also allowed the investment of black money in the stock market without question.

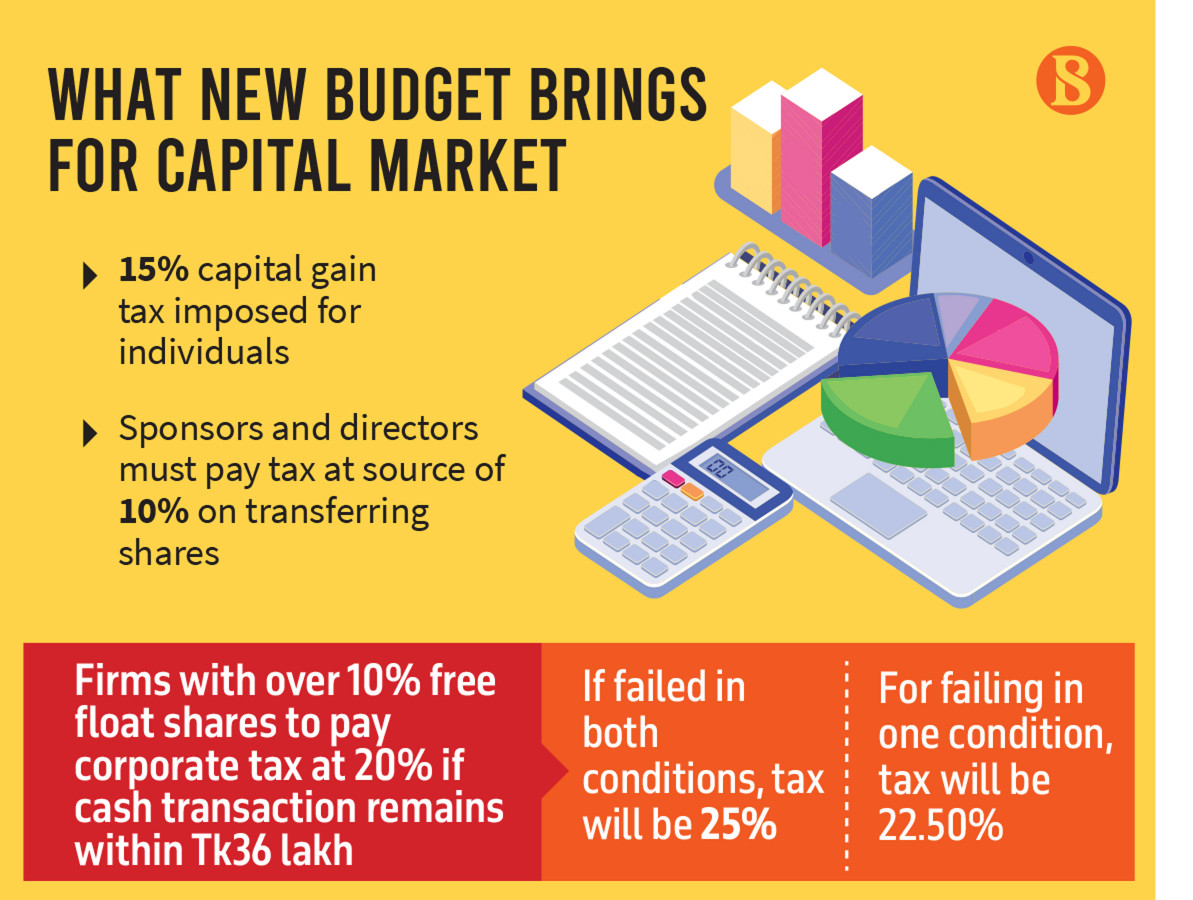

Individual investors will face a 15% tax on capital gains exceeding Tk50 lakh from the stock market in the upcoming fiscal year.

Finance Minister AH Mahmood Ali, while presenting the budget in parliament, also allowed the investment of black money in the stock market without question.

Professor Shibli Rubayat-Ul-Islam, chairman of the Bangladesh Securities and Exchange Commission, told The Business Standard that they did not expect any capital gains tax in the current market situation.

He emphasised the importance of black money for the capital market, stating that restricting its investment could lead to potential money laundering.

The issue of taxing capital gains gained attention following media reports, prompting protests from both the Dhaka Stock Exchange (DSE) and the Chittagong Stock Exchange (CSE) in press conferences.

Despite these protests, the finance minister did not accommodate the demands of the stock market stakeholders.

Furthermore, to incentivize the listing of reputable companies on the stock market, the new budget proposes widening the gap between corporate tax rates for listed and non-listed companies.

The DSE authorities had requested a reduction in the corporate tax rate for listed companies to 17.5% and an increase in the rate for non-listed companies from 37.5% to 40%. However, the finance minister did not take these suggestions into account.

In the proposed budget for the upcoming fiscal year, he did not make any changes to the corporate tax rates. If a listed company offers more than 10% of its paid-up capital in shares to the market, the corporate tax rate for that company will remain unchanged at 20%, subject to conditions. If the condition is not met, the tax rate for listed companies will be 22.5%.

For companies offering less than 10% of their paid-up capital in shares, the corporate tax rate will be 22.5%, subject to compliance with conditions. If these conditions are not met, the tax rate will be 25%.

The condition for enjoying a 2.5% reduced corporate tax rate for listed companies is that any transaction above Tk5 lakh and annual transactions exceeding Tk36 lakh must be conducted through banks. Companies not fulfilling this condition will not benefit from the reduced tax rate.

Meanwhile, the initiative to impose taxes on capital gains has caused unrest among investors in the stock market for several days. Despite this, the DSE saw a slight increase in both the index and transactions on Thursday, just before the budget presentation. The main index of the DSE increased by nearly 13 points, and transactions rose to Tk543 crore.

Finance ministry officials earlier told TBS that this initiative aligns with IMF recommendations aimed at enhancing revenue collection and ensuring fiscal discipline within the country's economic framework.

In 2015, individual investors were exempted from paying tax on capital gains from stocks, mutual funds, bonds, and debentures – a provision that may be revoked by the end of this fiscal year.

Capital market stakeholders have expressed concerns that the finance minister did not make any suggestions in the budget speech for the development of the capital market.

They are also concerned regarding the potential removal of the waiver of individuals' tax on capital gains. They highlight that individual investors outnumber institutions in the country, and their sentiment could further dampen the already bearish stock market.

Saiful Islam, president of the DSE Brokers Association, told TBS, "We do not want any tax burden on the capital market now, as it has been suffering for several years amid the global crisis. Any tax imposition will negatively affect the market, causing hardship for general investors."

He also mentioned that brokerage firms have been struggling for several years due to lower market participation amid the ongoing crisis.

The capital gains tax could create further uncertainty for the capital market.

Mazeda Khatun, president of the Bangladesh Merchant Bankers Association, told TBS earlier that it is not the right time to impose a capital gains tax for individual investors in the capital market, even though the government aims to enhance revenue collection.

"The capital market may react negatively to this, as the overall situation is currently very volatile," she added.

Mohammad Ali, a chartered accountant, previously told TBS, "Implementing taxation on individual stock market gains this year would be detrimental to capital market development, given that investors are already experiencing losses due to the market downturn."

"India started taxing long-term capital gains in 2018, after 200 years of their stock market history, whereas Bangladesh has a long way to go," Ali added.

Source: The Business Standard