In order to delist from the stock market, Savar Refractories Ltd — a bricks manufacturer that has been publicly listed since 1998 — has offered to buy out its public shares at a rate 56% lower than the market price.

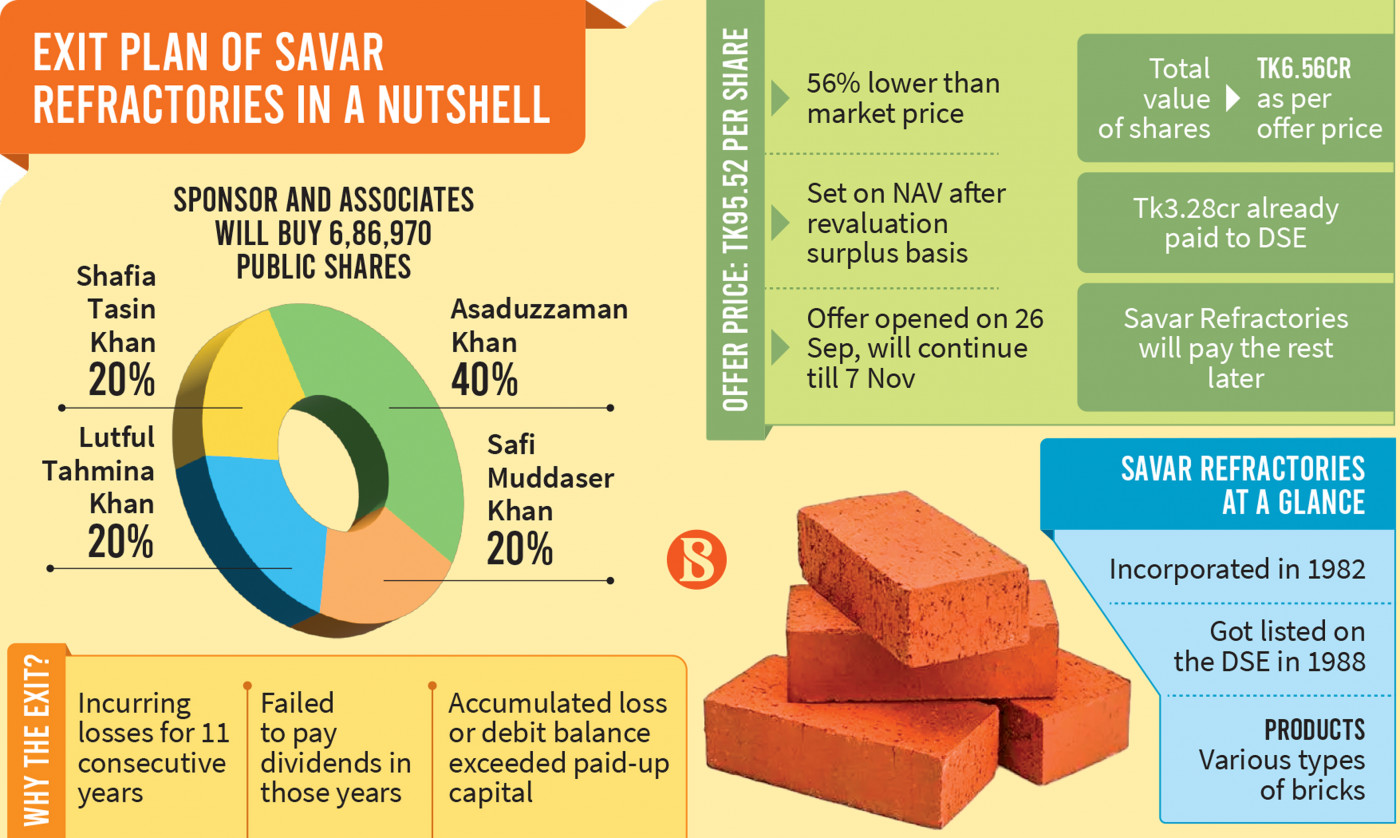

The total number of shares held by general investors is 6.86 lakh. As per the delisting plan, Home Minister Asaduzzaman Khan will acquire 40% of the public shares, while his wife, the company's Chairperson Lutful Tahmina Khan, his son and the company's Managing Director Safi Muddaser Khan, and his daughter, the company's Director Shafia Tasnim Khan, will each purchase 20%.

Savar Refractories has offered the shares held by general investors at Tk95.52 apiece, whereas the market price of the shares are Tk215.5 at the Dhaka Stock Exchange (DSE).

The offer price was set on the basis of net asset value after revaluation adjustment, according to a DSE public announcement.

As per the offer price, the total value of the general investor shares stands at Tk6.56 crore. The company has already deposited half of this amount to the DSE escrow account, and will deposit the other half later.

After receiving the applications from investors who are willing to surrender or sell their holdings at the offered price, the DSE will disburse the total deposited money among them.

At present, the paid-up capital of Savar Refractories is Tk1.39 crore. General investors hold 49.32%, and sponsor-directors hold the remaining.

In October last year, the company sought its stock market delisting, owing to its deep losses for 11 back-to-back years. Because of these losses, the company failed to pay dividends for those years.

Furthermore, its accumulated loss exceeded its paid-up capital. At the end of March 2023, its retained earnings stood at a negative Tk3.21 crore. And, the trading of its shares has been suspended since this May.

Earlier, the sponsor-directors of Beximco Synthetics applied to the regulator and also got approval to buy Savar Refractories public shares at the face value of Tk10 each.

Source: The Business Standard

Note: This email is for research and analysis purposes only.