Prime Bank Investment Limited (PBIL), the investment banking arm of Prime Bank, has recently introduced five products within the framework of its discretionary portfolio management service brand, "PrimeInvest."

This initiative aims to broaden access to investments, catering to individuals capable of saving a minimum of Tk3,000 per month or possessing savings of Tk5 lakh.

For the first time in Bangladesh, an investment bank is introducing a comprehensive range of discretionary products to address the wealth management requirements of general investors, whether they are individuals, institutions, or registered funds.

"At least one of our innovative products will suit the nature of your capital, return expectation, and risk appetite," Prime Bank Investment Managing Director and CEO Syed M Omar Tayub told TBS after the launching program at its head office in the capital earlier this week.

As this is a discretionary product suite, the investment bank will have the consent of customers to invest their money strategically in line with the underlying risk and return expectations.

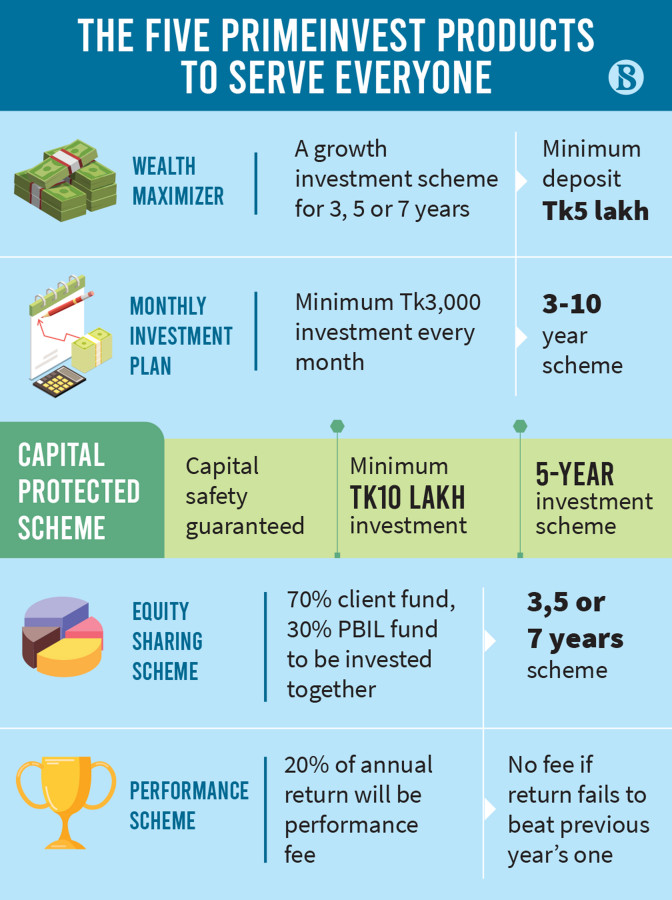

The PrimeInvest products

Wealth Maximizer: Investors can deposit at least Tk5 lakh for a tenure of three, five or seven years. PBIL will skillfully invest the money into growth stocks to maximise long term return. PBIL will charge 1% of the fund under management as annual fees.

Monthly Investment Plan: An investor who can save at least Tk3,000 a month, may deposit the amount or more every month for 3-10 years. The PBIL team will work to prove the power of the penny-pinching approach of long term investment in fundamentally sound stocks.

With a decent double digit annual average return, the forced savings may emerge as a large sum ultimately. PBIL will charge 2% of the total sum as annual fees.

Capital Protected Scheme: This product for risk-averse investors guarantees return of the deposited capital at least even if the investment manager incurs losses.

An investor will have to deposit at least Tk10 lakh for five years and all the positive return will be given to the investor after the tenure. PBIL will charge 2.5% of the total sum as annual management fees.

Equity Sharing Scheme: To prove the commitment for maximum efforts to ensure the best outcome for their clients, PBIL will invest 30% and the client will invest 70% of the size of an investment account. PBIL and the client will proportionately share the profits or losses.

An investor can deposit at least Tk5 lakh for three, five or seven years under the scheme. The investment manager will charge 1.5% annual management fees.

Performance Scheme: Another bold move by the investment bank. It will charge 20% of the annual profit as performance fees.

If there is no profit in a year, PBIL will not have any fee. Even if, profit is less than the previous year, the investment bank will take no fee for the year.

The huge potential

Through PrimeInvest, PBIL aims to bring in thousands of new investors to the capital market which has so far not been able to create enough new customers compared to the very large customer base seen in the money market or in mobile financial services accounts, said Syed M Omar Tayub.

Many of the general investors shy away from the capital market due to the time and effort required for successful investments.

The investment objective to provide investors with substantial returns to offset inflation will be achieved through a methodical investment approach tailored in line with the broader risk appetite and return expectation of client groups, he added.

To build a robust operation, the discretionary funds will be managed through the direct supervision of PBIL's Investment Management Committee.

PBIL Chairman C Q K Mustaq Ahmed said "The introduction of our innovative discretionary portfolio management products is an evidence of our commitment to innovation and to giving our customers the best possible service in their capital market investment."

Investors can open an account in PrimeInvest online.

Source: The Business Standard

Note: This email is for research and analysis purposes only.