Following a High Court order, the Dhaka Stock Exchange (DSE) is going to implement the minimum investment limit of Tk30 lakh for an investor to be eligible for trading on its SME board from October this year.

That means an investor who has been maintaining a portfolio of minimum Tk30 lakh in listed securities will be able to buy and sell shares in the SME board – a platform for trading small and medium companies' shares.

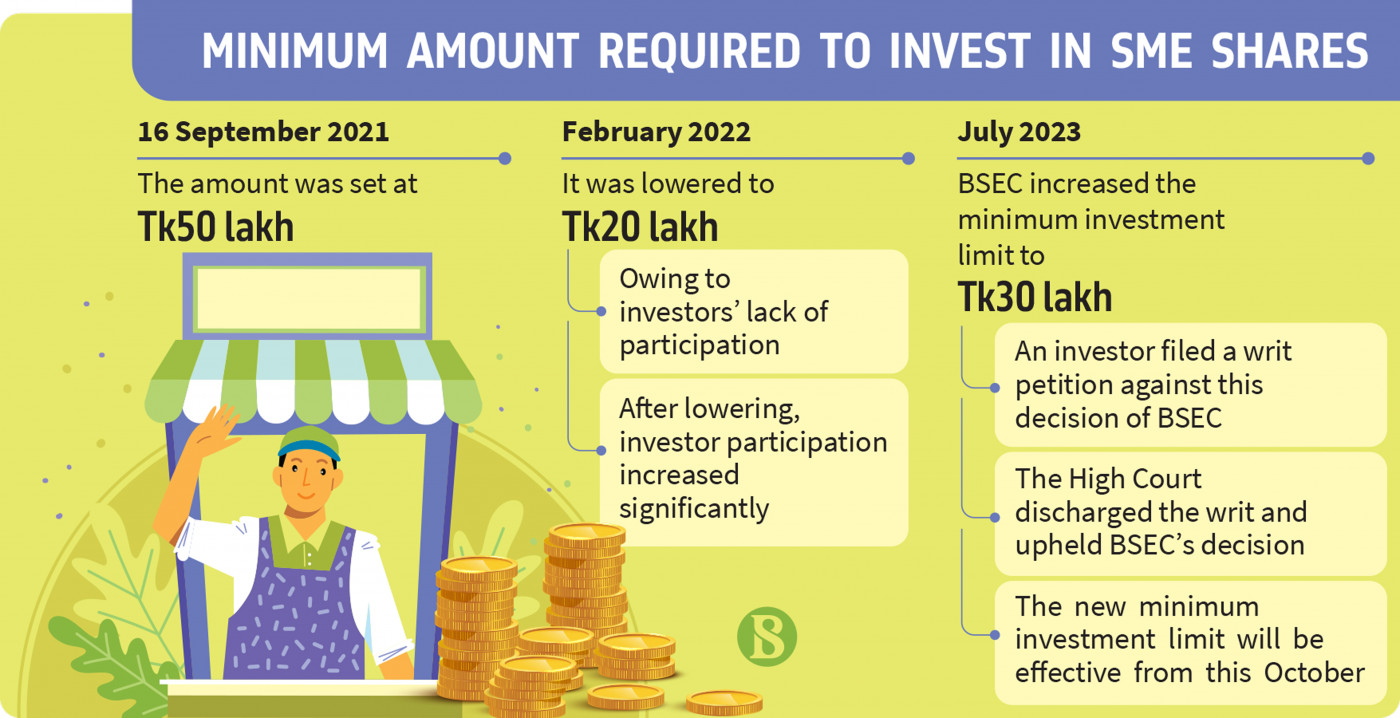

In November last year, an investor filed a writ in the High Court challenging the Bangladesh Securities and Exchange Commission's directive that set Tk30 lakh as the minimum required investment to be qualified for trading on the SME board.

As the writ was dismissed by the High Court, the securities regulators' directive requiring minimum Tk30 lakh of investment for trading small and medium companies' shares has been reinstated.

M Saifur Rahman Majumdar, chief operating officer at DSE who is serving as its acting managing director, told TBS that there are instructions to implement the new minimum investment requirement quickly, but it will be implemented from October due to procedural reasons.

He said the eligible investors' data is collected from the Central Depository Bangladesh – the country's only securities depository on stock settlements, transfer, dematerialisation, BO account opening/closing, SMS alerts and other services – at the end of each quarter. The new decision will be implemented after collecting the eligible investors' information at the end of the current quarter on 30 September.

In a disclosure issued on Monday, the Dhaka Stock Exchange requested all the interested investors to maintain a minimum investment of Tk30 lakh in listed securities at market value for registering as qualified investors in the electronic subscription system (ESS) of the exchange.

In 2021, the securities regulator set the minimum investment limit for the SME board at Tk50 lakh. Later the commission decreased the limit to Tk20 lakh as the investors were not interested to invest in the SME platform by complying with the condition.

When investor participation on the SME Board increased after lowering investment limits, the share prices of small-cap companies, which are relatively weaker than the main market, rose sharply.

Taking into account the risk of investors, the securities regulator raised the minimum investment limit to Tk30 lakh in September 2022 for an investor to be eligible for transactions on the SME Board.

At that time the securities regulator gave three months to the investors who had already traded shares on the SME Board with a portfolio of Tk20 lakh to increase their investment to Tk30 lakh.

However, after the writ against the securities regulator's decision was filed, the Dhaka Stock Exchange continued allowing investors with Tk20 lakh investment to trade on the SME Board as per the court's order.

The court dismissed the writ in June this year, and the final judgment was published recently.

The stock exchanges introduced their SME platform in September 2019 to attract businesses with small capital bases to the stock market and help them raise capital.

But in September 2021, the SME board of the Dhaka Stock Exchange (DSE) made its debut by trading shares of six companies.

At present, 17 companies are listed on the SME market.

The share price of the SME companies is too volatile as they are mostly low paid-up. As a result, this market is riskier than the main board of the bourses.

Source: The Business Standard

Note: This email is for research and analysis purposes only.