Linde Bangladesh's shares witnessed a sudden spike of over 43% on Thursday, in the wake of its announcement of record-high dividends.

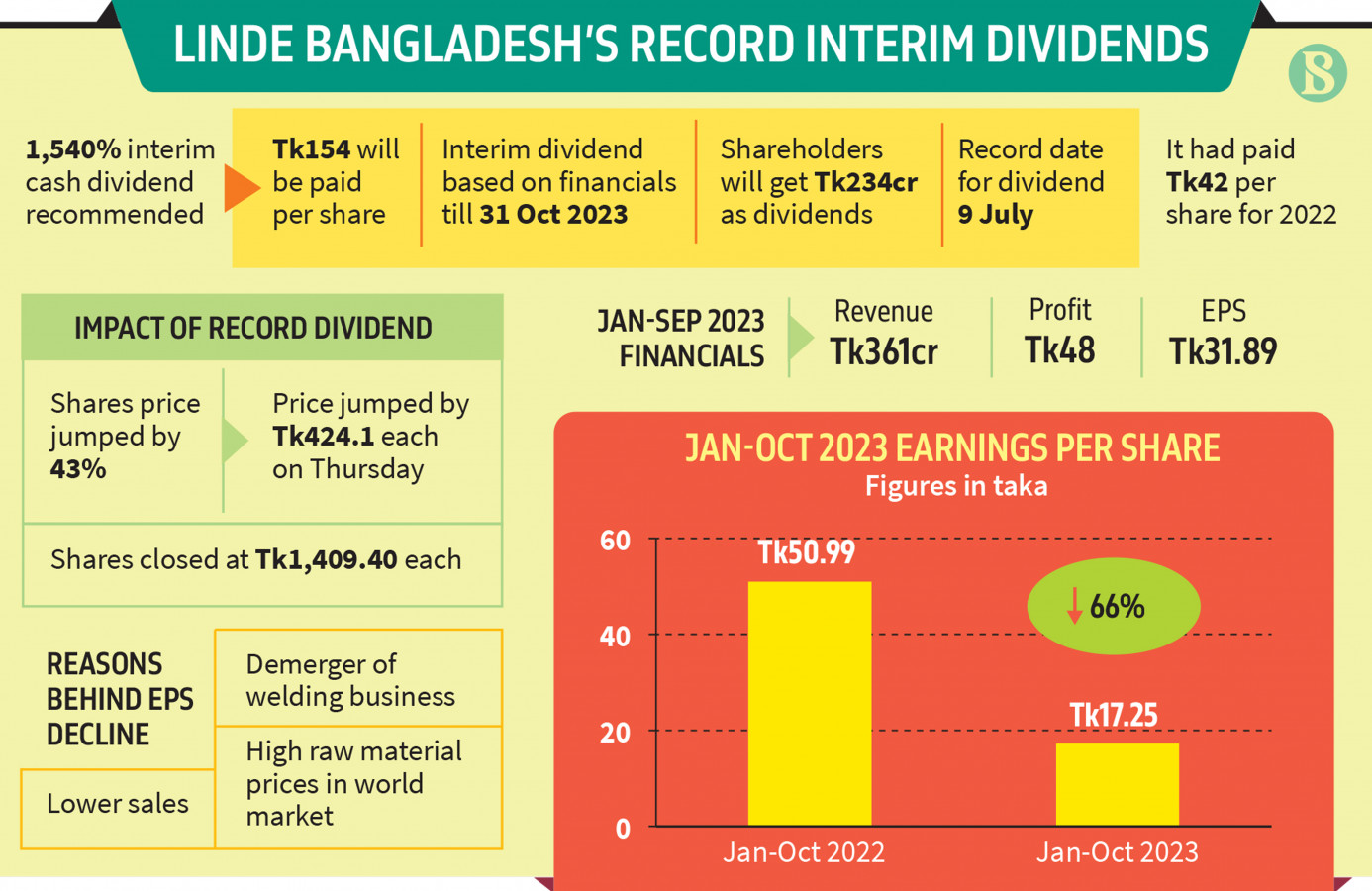

The leading medical and industrial gas producer in the country proposed to pay 1,540% interim cash dividends based on its January to October financials for 2023.

The multinational Linde Bangladesh will pay Tk154 per share as interim dividends, according to a disclosure published on the website of both stock exchanges on Thursday.

Shareholders are supposed to get Tk234 crore as interim dividends, and 9 July has been set as the record date for the entilement of dividends.

According to its disclosures, Linde Bangladesh recommends the highest dividends in its history even though it experienced a 66% fall in profits in the first ten months of 2023 compared to the same time of the previous year.

In May this year, Linde Bangladesh in its disclosure informed that it is going to sell its major revenue-generating segment - the welding electrodes business - to the American-Swedish industrial company ESAB Group.

That is why, the company is prioritising shareholders' returns over profitability so that buyers do not lose interest in its share, says stock market insiders.

A Linde Bangladesh official, seeking anonymity, told The Business Standard, "The recommended dividends is the highest ever."

Following announcement of the interim dividends, Linde's share price jumped Tk442.1 each or 43.04% to close at Tk1409.40 each at the Dhaka Stock Exchange (DSE).

According to the regulatory order circulated in June 2021, share prices may increase 7.50% in a day with values above Tk500 to Tk1,000 each.

But, Linde Bangladesh's share price jumped 43.04% as it was corporate declaration day when circuit breaker is not applied.

Linde Bangladesh declared interim dividends but it has not yet published its annual financials for 2023.

The multinational firm called a board of directors meeting on 27 June to consider, among others, audited financial statements for the year ended on 31 December 2023.

EPS fell 66%

According to the disclosure, the earnings per share (EPS) of Linde Bangladesh stood at Tk17.24 at the end of October 2023, which is down 66% over the same time of the previous fiscal year.

During the January to October period of 2023, its EPS was Tk50.99.

However, in the first nine months of 2023, its EPS was Tk31.89 from January to September.

That means, it incurred a loss in October, its EPS tumbling to Tk17.24 during the January to October period.

Regarding the fall in EPS, it said in the disclosure that EPS decreased due to the demerger of the welding business, lower sales and higher price of raw materials in the international market coupled with recent forex movement.

Demerger and selling of welding business

In October last year, Linde Bangladesh secured the High Court order for demerge of its hard goods business from a wholly owned subsidiary Linde Industries Pvt Ltd.

The demerger is part of Linde's strategy to create more focus on its gas business, according to a company official.

Now, the company is going to sell the welding electrodes business to the American-Swedish industrial company ESAB Group.

On 28 May, the board of Linde Bangladesh approved the share sale and purchase agreement (SPA) with ESAB Group.

The agreement involves selling the electrode segment operated by Linde Industries Private Limited.

The company will sell 13.82 crore shares of Linde Industries to the ESAB Group, according to the disclosure.

According to the ESAB website, it is a world leader in welding and cutting equipment and consumables, with business operations in 140 countries and 26 manufacturing hubs across the globe.

Linde Bangladesh was incorporated in 1973 and listed on the DSE in 1976.

Source: The Business Standard