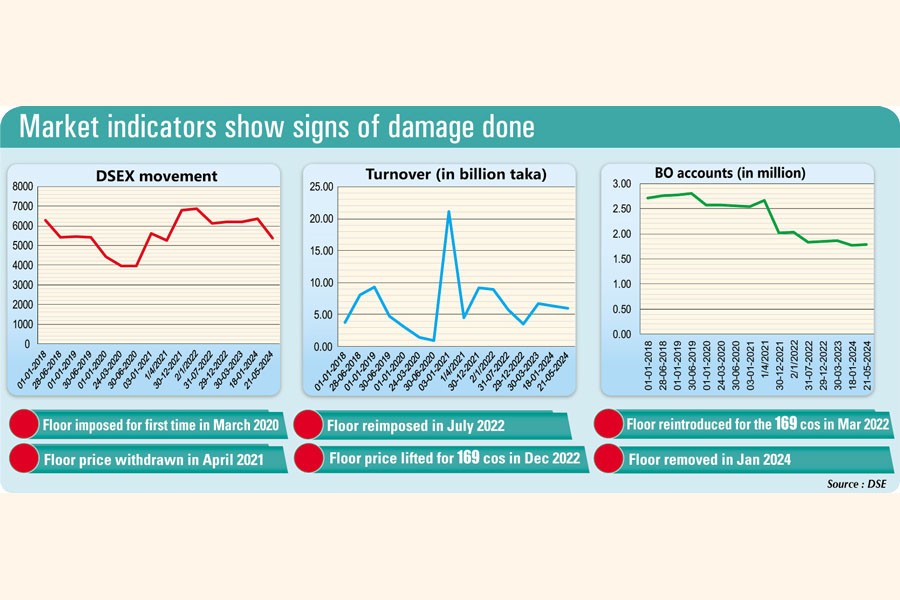

The floor price was in place for about 18 months to protect "small investors" but persistent bleeding of the index since its removal in January raises questions as to what investors or market achieved from the regulatory intervention.

The prime index of the Dhaka Stock Exchange (DSEX) hovered around 6,300 points for the duration when stocks could not be traded at lower than the minimum prices set by the Bangladesh Securities and Exchange Commission (BSEC).

Then it lost more than 15 per cent or 965 points, tumbling to a more-than-three-year low of 5,371 on Tuesday, since the removal of floor prices. So, the market has already plunged far below from the level where it was in July 2022 when the BSEC reintroduced the floor price.

At the same time, the market value of stocks on the DSE has been reduced by Tk 986 billion.

"It is now clear that the [floor] price restriction failed to protect the interests of small investors," said Yawer Sayeed, managing director of AIMS Bangladesh, the country's first asset management company in the private sector.

He argued that the artificial mechanism to keep stocks from falling was neither investor-friendly nor market-friendly. "It could have been imposed for a short time in an untoward situation. But the prolonged artificial mechanism damaged the market sentiment and dented investor confidence severely."

The BSEC set floor price for every stock in July 2022 for what it claimed was to safeguard general investors from stocks' free fall on the exchanges amid global economic uncertainties in the aftermath of the outbreak of the Russia-Ukraine war.

According to market experts, the regulatory intervention was the biggest impediment to the market's growth and is responsible for the present poor state of it.

The equity market has suffered a severe damage to its reputation due to frequent regulatory interferences. As a result, local and foreign investors have lost their appetite for stocks on Dhaka and Chittagong bourses.

Given the scope, foreign investors started selling their shares, which had remained stuck on the floor, in January to leave the market.

The floor was lifted at a time when the economic stress had been intensified by more recent challenges, including rising interest rates and a further devaluation of the local currency against the dollar.

Meanwhile, as stocks kept losing value the BSEC cut the minimum daily permissible correction of a security to 3 per cent from 10 per cent last month.

Market experts paint a possible picture of the market without the restriction.

If the floor price were not there, they say, the market initially would have declined and then would have gained equilibrium based on its own strength much like global stocks did.

Most of the global stock indices bounced back within six months after the war between Russia and Ukraine began in March 2022.

Most Asian frontier markets delivered a robust performance in 2023. Iraq was the best performer securing a 98 per cent return in 2023, followed by Sri Lanka (43 per cent), Pakistan (30 per cent), and Kazakhstan (29 per cent), well ahead of most Asian emerging markets, according to Hong Kong-based Asian Frontier Capital (AFC).

Bangladesh put up a very poor show, with a negative return.

Compared to global counterparts and regional peers, Bangladesh joined late in the game of rising interest rates and aligning core macro variables (i.e. exchange rate, interest rate) with the market, Salim Afzal Shawon, head of research at BRAC EPL Stock Brokerage, told the FE earlier.

Dr. M. Sadiqul Islam, who teaches finance at the University of Dhaka, said, "The imposition of floor price was conceptually a wrong decision. It violated the basic principle of liquidity."

Now, nothing is in favour of the capital market, said Saiful Islam, president of the DSE Brokers Association of Bangladesh.

High interest rates and cheaper currency drove the index down while high inflation squeezed people's disposable income. Profitability of many listed companies shrank due to high finance cost and import expenditure.

The foreign currency reserves, which had shot to an all-time high to over $48 billion in August 2021, dropped below $19 billion last week.

Owing to external and internal factors, inflation has stayed above 9 per cent for the past 20 months, one of the longest spells of cost-of-living crisis in recent memories.

The floor price is still applicable to six companies believed to be at risk of free fall and have a huge impact on the index.

Source: The Financial Express