Last week's lending rate hike by the Bangladesh Bank is feared to wipe out the remaining liquidity of the stock market as investors are likely to rush to divert investment to fixed-income assets.

As borrowing cost is going to go up, finance costs of listed companies will rise too, narrowing their profit margins. That will bring down the stock prices. On the other hand, the increase in lending rates will lead to higher deposit rates, and so fixed-income assets will give higher returns.

Such an outcome is anticipated since investors have already been looking for ways to exit the highly illiquid market.

The central bank on October 5 raised the loan/investment interest margin by 50 basis points in order to quell inflation that has been hitting hard limited-income group of people.

Now, banks will be allowed to charge borrowers a maximum of 3.5 per cent on top of six-month moving average rate of Treasury bills (SMART), the reference rate that was put in place in July this year to determine lending rate cap.

For the current month, SMART has been set at 7.2 per cent. By adding 3.5 per cent, banks will offer funds at up to 10.7 per cent interest rate.

The margin is also going to spike by 50 basis points to 2.5 per cent for pre-shipment credits and agricultural loans.

"This is not good news for the capital market. Now, bank deposit rate will increase. As the capital market is already illiquid, people will exit it once they get a chance," said Md Moniruzzaman, managing director & CEO of Prime Bank Securities Limited.

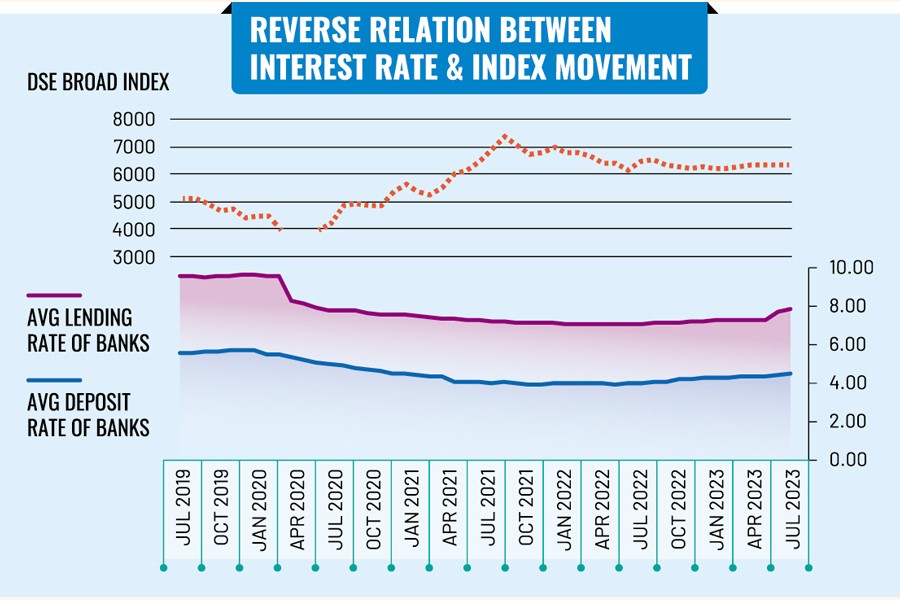

Data of the central bank points to the reverse relation between the interest rate and the index movement.

Four years ago in July 2019 when scheduled banks' weighted average deposit rate was 5.57 per cent and lending rate 9.59 percent, the main index of the Dhaka Stock Exchange (DSE) stood at 5,139 points.

When the deposit rate and the lending rate fell to 4.01 per cent and 7.15 per cent in October 2021, the index jumped to 7,000 points.

By August this year, the index slumped to 6,300 points when the deposit rate was back up to 4.52 per cent and lending rate to 7.85 per cent.

On Sunday, 91 days' Treasury bills were sold at 9.25 per cent, 182 days' T-bills at 9.50 per cent and 364 days' T-bills at 9.75 per cent.

That means the lending rate may Jump to as high as 13% in the months to come.

This is the backdrop to retail investors' turning to fixed deposit receipts (FDR) and Treasury bills, given an opportunity, for safer and higher returns on investments.

Institutional investors too will leave the market for they can invest as much as they can in fixed-income securities, said Syed Mahbubur Rahman, managing director & CEO of Mutual Trust Bank Limited (MTB).

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said interest rate hike was a good decision for the economy but it would have short-term impacts on the stock market.

He, however, believes the main issues that have kept the market down are floor price and the gloomy macroeconomic situation, which will persist until the national election.

Higher borrowing costs will compel companies, which have been expanding production with cheap loans, to slow down growth.

But bank stocks may benefit out of the shift in lending policy, said Mohammad Emran Hasan, chief executive officer of Shanta Asset Management.

Banks are likely to experience a growth in deposits and an increase in profitability, boosting the stock prices.

Similar should be the case with non-bank financial institutions (NBFIs).

A circular issued on Sunday said any NBFI will be able to pay depositors at a maximum of SMART plus 2.5 per cent, up from 2 per cent, while charge borrowers at a maximum of SMART + 5.5 per cent interest rate.

Md Moniruzzaman, of Prime Bank Securities, is skeptical about price appreciation of bank stocks. He said investors had lost faith in banks because of their malpractices leading to their poor health.

On what can help the market rebound despite high interest rates, Mr Mansur said floor price should be withdrawn.

To keep liquidity flow, the Bangladesh Securities and Exchange Commission should issue more debt securities, said Shahidul Islam, chief executive officer of VIPB Asset Management Company.

Source: The Financial Express

Note: This email is for research and analysis purposes only.