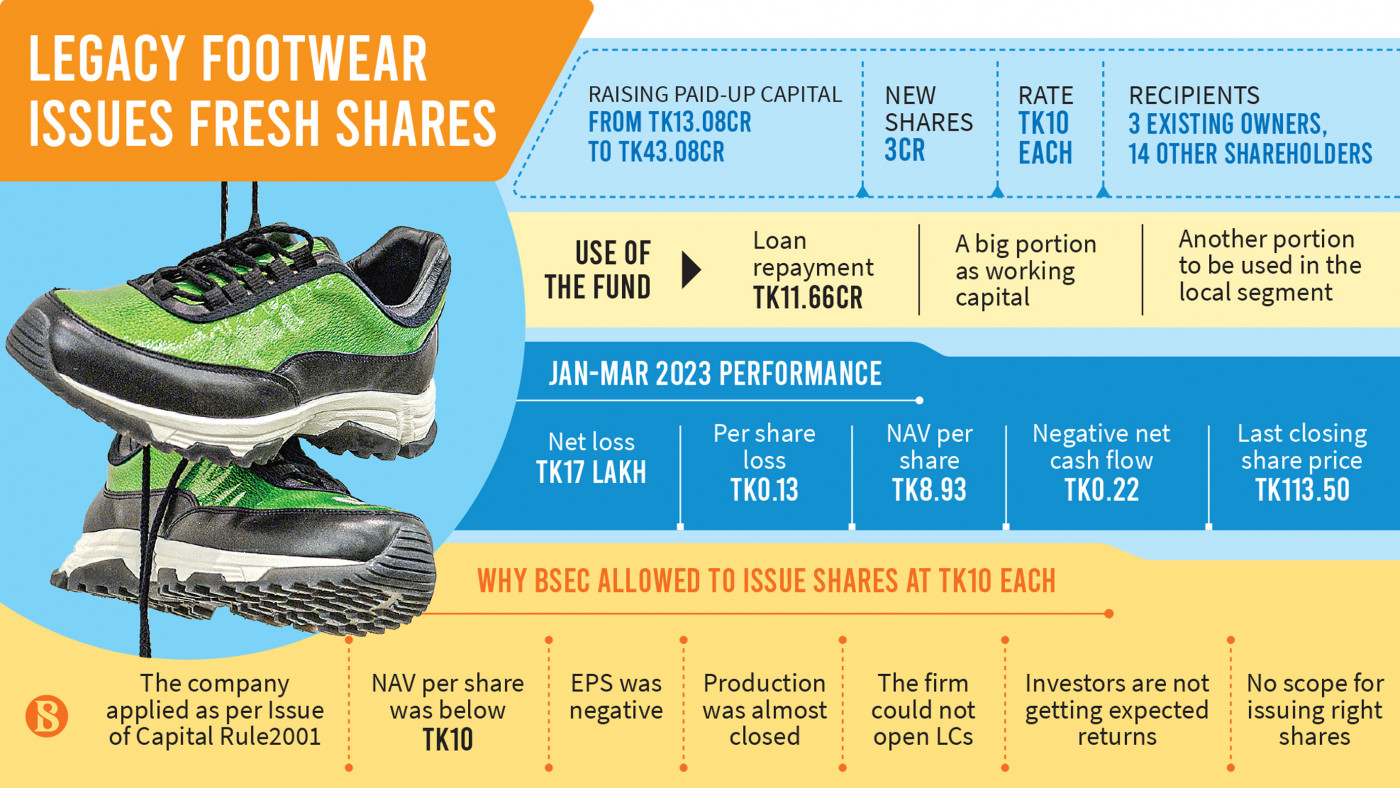

Legacy Footwear has issued three crore shares priced at Tk10 each to three existing sponsors and directors and 14 other investors.

The company's share price closed at Tk113.5 each on the Dhaka stock exchange on Tuesday (12 September).

As per the current value, the price of Legacy Footwear's three crore shares is Tk340.50 crore, but the newly issued shares fetched only Tk30 crore.

Market insiders have alleged that general investors were deprived of the newly issued shares due to the securities regulator's approval for private placement of these shares, and as a result they might not get their expected return and lose confidence in the capital market.

The sponsors and directors of the company will not be able to sell the newly issued shares within the next three years, while the 14 other investors will not be able to sell them within the next one year.

Abu Ahmed, a senior stock market analyst and a former professor of economics at Dhaka University, said the regulator should prioritise protecting general investors, who should not be deprived of such opportunities of acquiring a company's shares.

He also said the period during which the owners of the new shares will not be able to sell them should be increased, so that they cannot manipulate the capital market.

Legacy Footwear raises capital to boost business

Legacy Footwear, an export-oriented company, has been facing challenges due to lack of working capital, and problems in opening letters of credit (LCs) for the last few years.

To resolve the crisis, the company decided to increase its paid-up capital and meet the regulatory requirements.

Recently, the company got an exemption of interest of around Tk19.94 crore from the Rupali Bank. The company has to repay around Tk11.66 crore to the bank.

Legacy Footwear Managing Director Quazi Rafi Ahmad told The Business Standard, "We wanted to offer the rights share but the company could not comply with the regulatory requirements. That is why we went for private placement to run the company properly for the greater interest of investors."

Now the company wants to repay as much of its loan taken from the Rupali Bank as possible, he added.

He also expressed hope that the company would be able to complete a new unit within a couple of months with the new capital.

Earlier, he said the company wants to penetrate the local market, a large portion of which is held by non-branded products.

"If we provide quality products at affordable prices, then it will not take us long to capture this market. Our sales will increase quickly if we can capture even a small portion of the market within two or three years," he added.

Why BSEC approved the shares at Tk10

In April this year, the Bangladesh Securities and Exchange Commission (BSEC) allowed the company to increase its paid-up capital to Tk43.08 crore by issuing three crore ordinary shares through private placement.

This measure enabled Legacy Footwear to comply with the requirement of Tk30 crore minimum paid-up capital.

BSEC Executive and Spokesperson Mohammad Rezaul Karim said the commission allowed the issuance of the shares for the greater interest of general investors according to the "Issue of Capital Rule 2001".

He said when the commission was considering giving approval for the new shares, its net asset value per share was below Tk10, and its earnings per share were negative, making it a losing concern. Besides, it could not open letters of credit for loans.

The company was about to close. In this stage, the securities regulator approved the shares considering the benefits of the investors and the owners, he added.

From January to March 2023, the company incurred Tk17 lakh losses. Its loss per share was Tk0.13 and its net asset value per share stood at Tk8.93 at the end of March 2023.

Declining exports of its products and electricity disruptions in the country in the past few months have caused losses for the company during the period.

In FY22, it posted Tk1.12 crore loss, and did not declare any dividend for its shareholders.

In FY21, it made Tk52 lakh profit and paid a 1% cash dividend to the shareholders.

Legacy Footwear started its footwear business in 1996 as a 100% export-oriented company, but it could not establish itself in the export market. It was listed on the Dhaka Stock Exchange (DSE) in 2000.

Source: The Business Standard

Note: This email is for research and analysis purposes only.