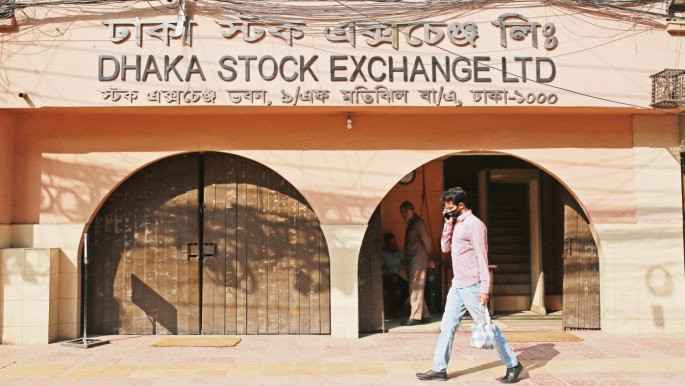

The Bangladesh capital market awaits its first ever exchange traded fund (ETF) by the end of this year, according to officials of the Dhaka Stock Exchange (DSE) and LankaBangla Asset Management Company which is going to manage the maiden ETF "LB Multi Asset Income ETF".LankaBangla Asset Management Company, at its corporate office in the capital on Monday, has signed the trust deed with the trustee Bangladesh General Insurance Company (BGIC) to launch the new investment vehicle.According to the regulatory approval letter issued in December last year, the Tk100 crore ETF will be an actively managed one. That means the asset manager will choose portfolio scrips and investment allocation based on its discretion in compliance with the regulations.On the other hand, passively managed ETFs simply mimic an index to build a portfolio in terms of both the constituent scrips and portfolio weight.An ETF is a collective investment scheme that is built out of pulled capital to invest in pre-announced assets.How it will workLB Multi Asset Income ETF will be publicly listed and traded like other scrips in the DSE.Having invested the initial capital pulled, the asset manager will keep publishing the real time net asset value (NAV) per unit. The regulations dictate that the NAV will be the reference for the market price of the ETF units.Authorised participants (AP) will be actively making the market so that unit price in the secondary market does not deviate by more than 10% of the NAV.Three reputed brokerage firms — LankaBangla Securities, Green Delta Securities and United Financial Trading Company — will act as the APs of LB Multi Asset Income ETF.If high demand pushes the secondary market price of the ETF unit above the NAV, the APs can sell units they hold, or even short sell the units and finally let the asset manager create new units to cater to the higher demand.On the flipside, if higher supply in the secondary market pushes the ETF unit price down, APs will buy units from the market. And at some point of increasing supply, unit redemption might be needed.ETF, thus, help create market liquidity and opportunity for investors to park their money in the market through a comparatively stable investment vehicle.Continuous creation and redemption of units will result in funds inflow and outflow in the underlying securities via the ETF.The return benchmark set for an ETF is the yield of 10-year Bangladesh Government Treasury Bonds that means the asset manager will eye a return higher than the benchmark rate that is above 9% nowadays.Alongside potential capital gains, ETF investors' total return will also include cash dividends.LB Multi Asset Income ETFLankaBangla Investments, a leading merchant bank of the country, will provide Tk10 crore as the sponsor of the ETF, while the asset manager will provide Tk2 crore.The rest of the amount to build a Tk100 crore ETF will be raised from investors in two phases—through private placement at first, and later through a public offering of the ETF units.Brac Bank will be custodian of the invested securities and Hoda Vasi Chowdhury & Co Chartered Accountants will be the auditor of the ETF.Top officials of the DSE, LankaBangla and BGIC spoke at the trust deed signing ceremony.DSE Acting Managing Director M Shaifur Rhaman Mazumdar said ETFs would help increase the depth of the market and his bourse was excited for the debut of the new instrument.There should be many more new funds under the management of professional asset managers, he added.Observers were expecting the maiden ETF years earlier as the comparator markets started benefitting from such instruments long ago."Better late than never," said Bangladesh Securities and Exchange Commission Executive Director and Spokesperson Rezaul Karim.The first ETF was taking a bit longer as it involved so much preparation by each stakeholder, he told TBS, adding that the securities regulator was eager to let more of such funds float in the coming days."As soon as the asset managers apply for the next phases to raise money from investors, the BSEC will fast-track its approval process for the ETF," he added.The BSEC, in December last year, also accorded its nod to launch another actively managed ETF named FAM DG Bengal Tiger ETF with an initial target size of Tk50 crore.

Source: The Business Standard

Note: This email is for research and analysis purposes only.