The SME market index soared 259 points, or 20 per cent, in the month to Thursday amid an influx of investors at a time when the main market has been enduring price erosion.

During the time, the prime index eroded 426 points, plummeting to three-year low to 5,968 on Thursday against the backdrop of dwindling investor confidence. Investors have been shaky especially since the removal of the floor price from large-cap stocks amid rising interest rates.

Meanwhile, due to the price surge of SME stocks, the market value jumped 25 per cent in the month to Tk 29.39 billion while the market cap of the main board of the Dhaka Stock Exchange (DSE) shed Tk 723 billion during the time.

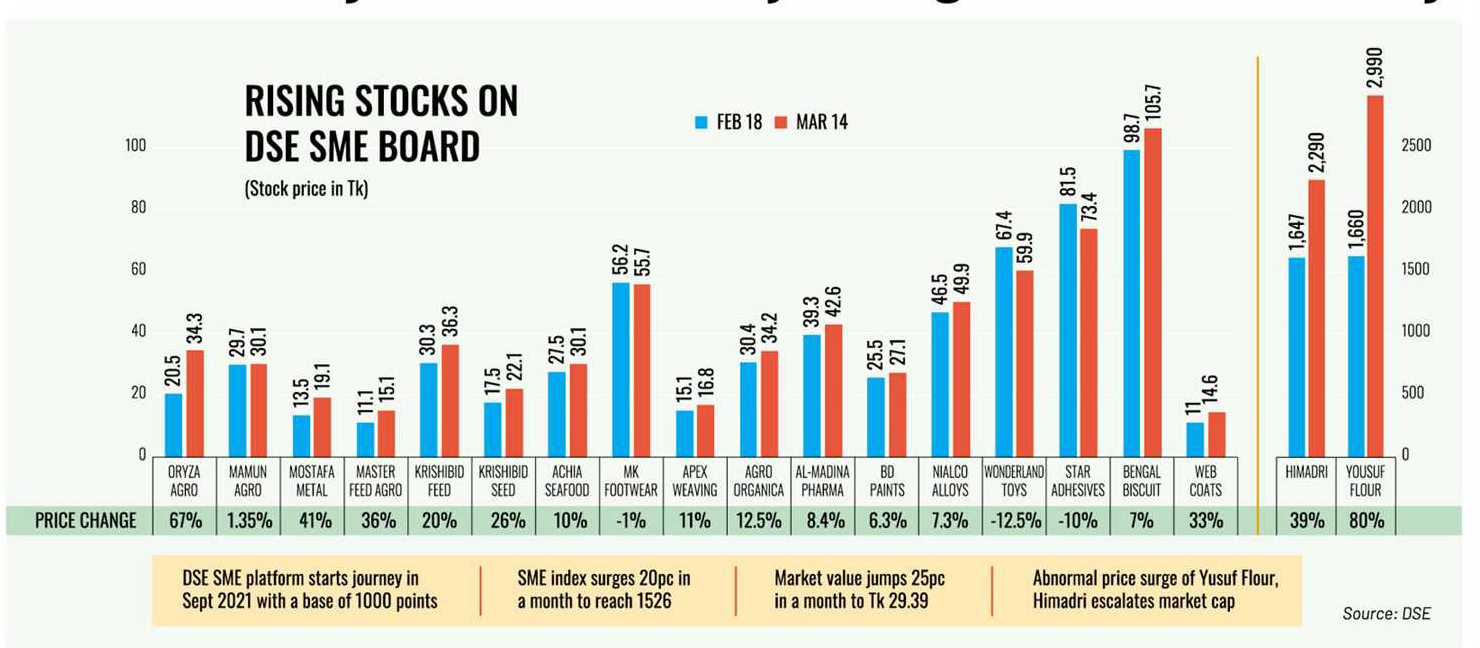

Except for MK Footwear, Wonderland Toys, and Star Adhesives, all SME stocks experienced price increase by 1.35 per cent to 80 per cent in the month, driven by rumours that their prices would increase further.

What is more surprising is that two little known SME stocks -- Yusuf Flour Mills and Himadri -- exhibited abnormal price hikes, becoming the second-most and fourth most-expensive stocks respectively on the exchanges.

Yusuf Flour jumped an astounding 80 per cent or Tk 1,330 each share in just one month to Tk 2,990 per share on Thursday, emerging as the most expensive stock after Reckitt Benckiser.

The stock of Himadri soared 39 per cent in the month to Tk 2,290 per share, beating well-performing stocks, such as Square Pharma, Grameenphone, Renata, and BAT Bangladesh in the main market.

Although Yusuf Flour and Himadri have escalated at a fast pace, the number of trades and trade volume remained insignificant.

In the absence of any valid reason behind the price appreciation of SME stocks, analysts fear that gambling acted as a short-term catalyst.

The listed SMEs have floated a small number of shares. So, when speculations do the rounds that a stock would continue going up, buying pressure even from a small group of general investors eventually helps the stock escalate.

Low paid-up capital makes it easy for gamblers to manipulate the price, said Prof Abu Ahmed, a former chairman of the economics department of the University of Dhaka.

"The trading pattern of some SME stocks looks unusual," he said, adding that without manipulation the kind of price jump was not possible.

Himadri, which runs six potato cold storage units in the northern part of Bangladesh and is a subsidiary of Ejab Group, has offloaded only 0.75 million shares, the lowest among listed SMEs.

To comply with the regulatory requirement, the board of Himadri declared a 700 per cent stock dividend for FY23. However, the stock market regulator allowed disbursement of 250 per cent bonus shares, taking the total number of shares to 2.62 million, still very low.

Echoing Prof Ahmed, Md Sajedul Islam, managing director of Shyamol Equity Management, said a small volume of shares might be a reason behind the artificial price increase.

Yusuf Flour's total number of shares is only 0.60 million, of which 53.88 per cent is held by sponsors, according to the DSE data.

Mr Islam said a certain group of people might have purchased a majority of its shares. They have traded shares within the group to create a demand for the stock. When general investors will join the rally, the fraudsters will offload their holdings.

The SME board has created scope for manipulators to make unprecedented gains at a time when the main market is in distress, said a merchant banker, requesting not to be named.

However, he said, as the main market has remained unattractive, many investors are chasing these small-cap stocks, watching price movement, in the hope of making short-term gains.

The securities regulator has recently downgraded 29 low-performing stocks in the main board to 'Z' category in two phases and many other poor-performing stocks are at risk of being transferred to Z category, which might have prompted investors to shift their money to the SME board, said the merchant banker.

However, no fundamental changes took place, which could push the SME stocks up.

"That indicates a group of dishonest traders have been targeting the SME board to manipulate stocks," said Prof Ahmed.

A top official of the Bangladesh Securities and Exchange Commission said the abnormal spike in share prices of small-cap companies had drawn the attention of the securities regulator.

"We are keeping a close watch on the shares of small-cap companies to see if there is any wrongdoing," he said. Investors also need to be cautious while putting money in such speculative stocks, he added.

Source: The Financial Express