Mohammad Juel Rana [not the real name] grew impatient as he could not encash his stock investments even in three months in absence of buyers.

Having been cash-strapped for a while, he called up his broker to inquire if there was any way to find a buyer willing to buy his holdings at a discounted price. Finally, he managed to sell shares at 20 per cent lower than the floor price.

"I needed money immediately. The market did not leave me with any other option," he said.

Rana is not the only individual who has got trapped in a situation like that after the imposition of floor price in July 2022.

The regulatory move, which was intended to avert free fall of securities, turned the market almost illiquid. As days stretched into months and then a year, many small investors saw financial pressure mounting on them, leading to the adoption of unofficial means to trade stocks.

The irony is that the Bangladesh Securities and Exchange Commission on several occasions defended its position to keep the price restriction on the pretext of protecting small investors like Rana.

How transactions are done

The Financial Express reached out to several stock brokers to learn how such transactions are possible when the market does not allow any trade at below the lowest prices set by the regulator.

In the case above, the seller had an unofficial negotiation with the buyer and agreed upon a certain quantity of shares and a time to execute the transaction on the Dhaka Stock Exchange.

So, when the sell order was placed at that particular time, the buyer purchased the entire holdings at the floor price. Later on, the seller paid back the buyer in cash the 20 per cent excess amount out of his pocket.

Such type of trading is easier on the block board, where each transaction is done after a deal has been struck between the two parties, and every trade entails at least Tk 0.5 million.

Since November last year, investors have been allowed to trade shares at a 10 per cent discount on the floor price on the platform. The seller after a trade gives back cash to the buyer based on the price negotiated between them.

Md Shakil Rizvi, managing director of Shakil Rizvi Stock Limited, said, "Such transactions are possible. We have heard about this happening in the market but we have no data.

"If buyers and sellers make deals and settle those outside the market, it is difficult to trace them," said Mr Rizvi, also a director of the Dhaka Stock Exchange (DSE).

Reasons behind such trades

In the last more than a year, inflation shot through the roof, causing an escalation of the living cost. While wealthy people have financial means to absorb the additional financial burden, low and fixed-income people started digging into savings to survive.

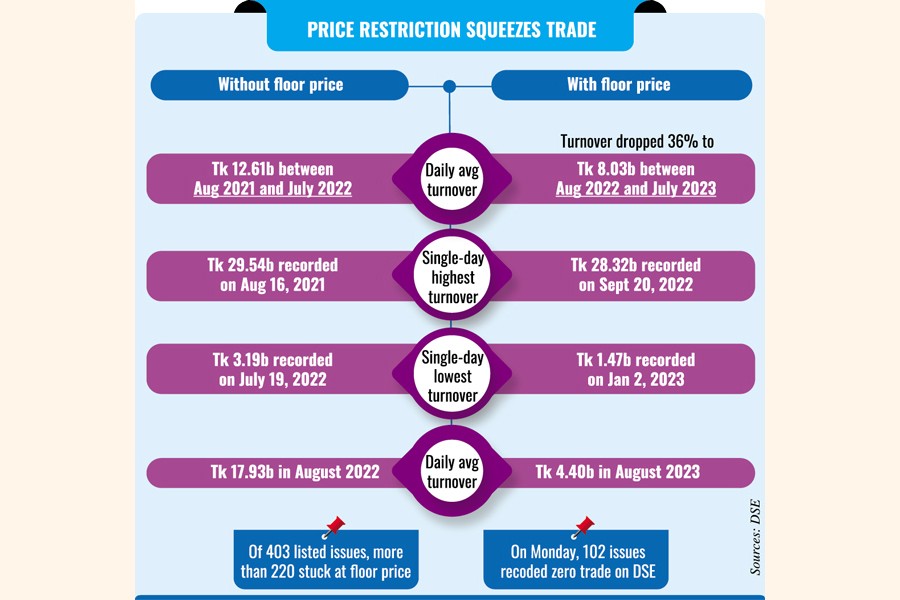

Against this backdrop, the stock market, usually seen as a highly liquid market, has blocked access to cash, and that has reflected on the sharp decline in daily turnover in the last one year, compared to the year before the floor price was put in place.

Many securities, especially the stocks with large market cap, have been languishing at the lowest prices set by the regulator. Many of them have had no trade for days and months at a stretch.

On Monday, 102 issues recorded zero trade on the DSE.

The persisting illiquid stock market and heated up consumer market forced small investors to find a way out of the former.

In such a pursuit, brokerage houses sometimes help clients find buyers to sell shares at a discounted price. And those who have money in disposal grab the opportunity.

"Floor price has created an opportunity for some people [to make gains in future]," said Ahmed Rashid Lali, managing director of Rashid Investment Services.

Troubled brokers help clients out

As daily transactions plunged on the bourses, the brokers that rely upon commission fees for continuing operations have seen a massive dent in their income.

On the other hand, their own investments in stocks have been yielding low for the thin scope of making capital gains and low dividend income as most companies have seen their business squeezed.

Hence, helping clients sell off stocks through an unofficial arrangement is also luring for brokers as that increases transactions to some extent.

Sharif Anwar Hossain, former president of the DSE Brokers Association (DBA) of Bangladesh, said brokerage houses were on the verge of collapse, having become unable to pay staff salaries.

For the lack of buyers, the brokers cannot sell stocks from their own portfolios too to meet operating expenses.

Source: The Financial Express

Note: This email is for research and analysis purposes only.