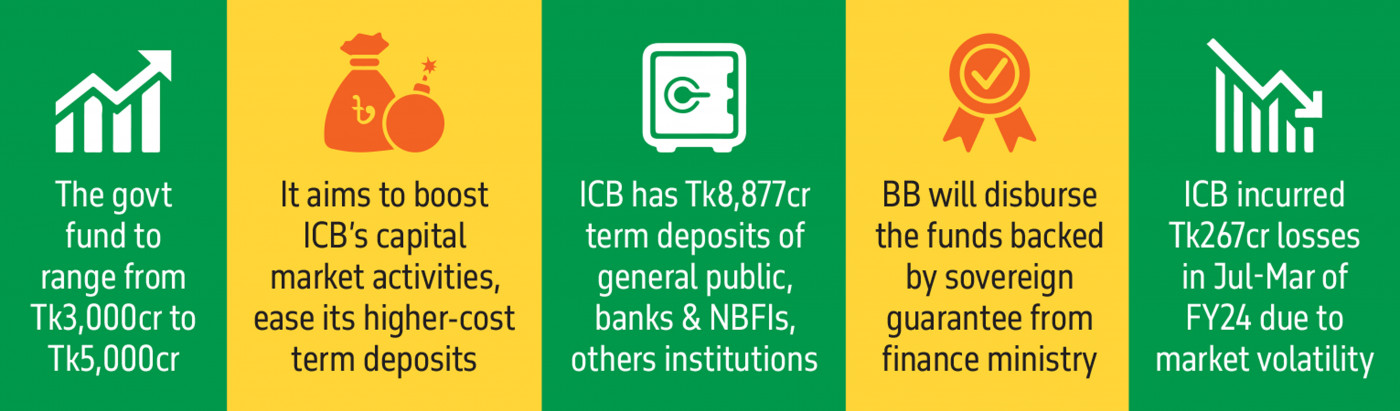

The Investment Corporation of Bangladesh (ICB) – a state-owned entity primarily tasked with stock investments – is set to receive a fund infusion ranging from Tk3,000 crore to Tk5,000 crore from the government, aiming to boost its capital market activities and repay some of its higher-cost term deposits.

The Bangladesh Bank will provide the fund – backed by a sovereign guarantee from the finance ministry – to the investment bank, according to officials with knowledge of the matter including individuals associated with the Bangladesh Securities and Exchange Commission (BSEC), the finance ministry, and the ICB.

A finance ministry official, who spoke on condition of anonymity, indicated that the decision was made in line with government recommendations that underscore the administration's proactive approach to supporting capital market initiatives by the ICB, one of the largest investors in the share market.

Suborna Barua, chairman of the ICB, told The Business Standard, "We are very positive and hopeful about getting the fund support from the government for the stock market. The relevant authorities have asked the ICB to submit a proposal, and we are working on it.

"As the prime mandate of the ICB is to support the stock market, a portion of the fund will be injected into the capital market. Also, some of the fund will be used to repay the high-cost term deposits taken by the ICB over the years to support the market."

Barua, also an international business professor at Dhaka University, said the fund support was desirable. Besides strengthening ICB's investment capacity, the fund will help stabilise the market. "So, it will be very positive for us and the stock market," he added.

A top official at the BSEC, seeking anonymity, told TBS that they have also talked with the Bangladesh Bank regarding the fund. "The central bank has agreed to provide the fund. If the fund is released, the investment capacity of the ICB will be strengthened, and the overall market will benefit," he added.

Owing to the liquidity crunch amid rising interest rates, the country's stock market has been in a volatile situation, which has resulted in a significant fall in indices and turnover on both Dhaka and Chattogram stock exchanges.

Volatile market drags down ICB's profits

Investors witnessed a significant capital erosion, and the market capitalisation dropped by around Tk1 lakh crore primarily following the removal of the floor price restriction in January, around two years after its imposition in July 2022. The floor price is the lowest price at which a stock can be traded, and shares cannot fall below this level.

In a move to arrest market volatility, the BSEC on 24 April capped a limit for the stocks by 3% intraday fall.

Due to market volatility, the ICB incurred a loss of Tk267 crore in the first nine months of the fiscal 2023-24.

Its capital gain fell by 59% to Tk105 crore, and its interest payment on deposits and borrowing increased by 9.61% to Tk675 crore.

The investment bank suffered a profit decline of 46% to Tk77 crore for the fiscal 2022-23.

Also, the ICB failed to pay back its depositors as it could not sell the shares amid floor price restrictions.

Term deposits become a burden

According to the annual report for FY23, the ICB has Tk8,877 crore in term deposits from the general public, banks, non-bank financial institutions (NBFIs), and other institutions.

A recent jump in interest rates has pushed the repayment pressure on the institution.

Banks and NBFIs account for Tk5,322 crore of the term deposits, while Tk3,546 crore is from other institutions.

Sonali Bank, Sadharan Bima Corporation, Agrani Bank, and Janata Bank have Tk3,563 crore in term deposits with the ICB. The investment bank has paid Tk663 crore in interest for term deposits, according to its annual report.

ICB's funds are also stuck in other institutions

According to officials, the ICB has around Tk1,000 crore in investments, mostly in weak banks and NBFIs, with Tk154 crore stuck with Padma Bank alone.

Despite the maturity of the deposits, the ICB failed to recover the funds. The ICB sought the central bank's help to recover the funds but the NBFIs failed to pay back deposits, resulting in the renewal of the tenure for most funds.

Source: The Business Standard