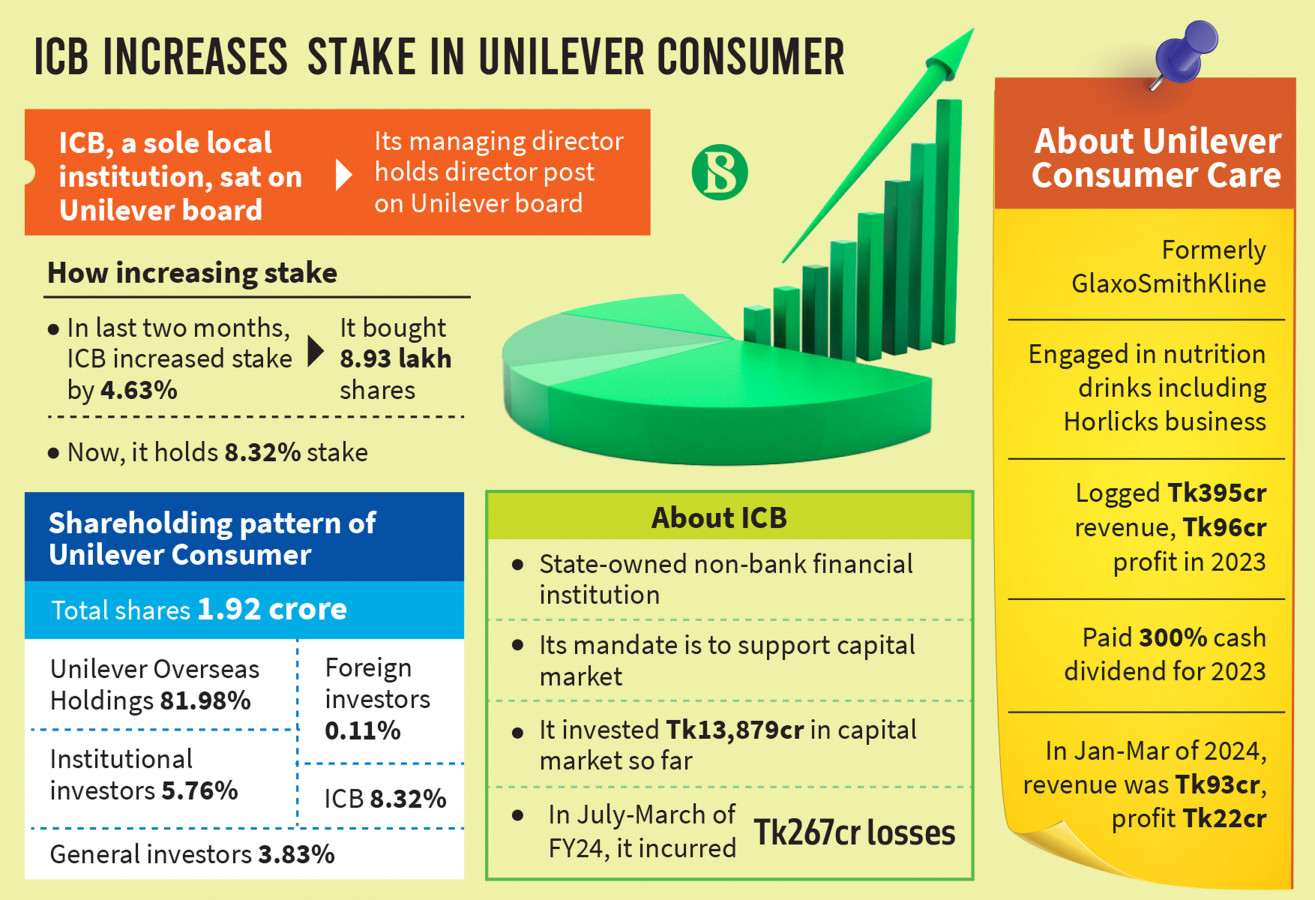

In a strategic move to bolster its portfolio, the Investment Corporation of Bangladesh (ICB) has acquired a 4.63% stake in Unilever Consumer Care Limited over the last two months through the Dhaka Stock Exchange (DSE).

The state-owned non-bank financial institution, primarily tasked with supporting the capital market, has long served as a corporate director on the board of the multinational company.

Between April and May, ICB bought a total of 8.93 lakh shares, or 4.63% of Unilever Consumer, for Tk188 crore through the block market at the DSE.

By the end of May, its holdings in Unilever Consumer Care had increased from 3.69% to 8.32%. Specifically, ICB purchased 37,382 shares in April and 8.55 lakh shares in May.

In May, Unilever Consumer Care's shares surged over 28% to Tk2,341 each, but closed at Tk2,011.30 on Wednesday.

This acquisition underscores ICB's commitment to expanding its investments in high-growth sectors and trusted brands, according to its officials.

Unilever Consumer Care, known for its robust market presence in the health drinks sector with the flagship brand Horlicks, stands to benefit from this enhanced backing, while ICB is poised to leverage the synergies from this collaboration to deliver value to its shareholders, they added.

Due to the increase in ICB's stakes, the holdings of sponsors and directors in Unilever Consumer Care exceeded 90%, while the public portion decreased to less than 10%.

ICB purchased these shares during a period when it incurred losses due to the bearish trend in the market, suffering a loss of Tk267 crore during the first three quarters of the fiscal 2023-24.

In May, ICB urged the government for financial support amounting to Tk5,000 crore, aiming to boost its capital market activities and repay some of its higher-cost term deposits.

ICB Chairman Suborna Barua told The Business Standard earlier, "We are very positive and hopeful about receiving financial support from the government for the stock market. The relevant authorities have asked ICB to submit a proposal, and we are working on it."

Meanwhile, Unilever Consumer Care paid a total cash dividend of 300% for the year 2023, during which its net profit surged by 32%.

This dividend distribution represents 60% of the company's total profit for the year.

According to the financial statement, Unilever Consumer's net profit rose to Tk96.15 crore in 2023 from Tk73.04 crore a year earlier.

In its statement, Unilever Consumer mentioned that despite a significant increase in raw and packaging material costs and a drop in revenue, profit improved due to efficiency in operating expenses, a significant increase in net finance income, a one-off benefit from reassessment of past liabilities and obligations, and a one-off waiver of technology and trademark royalty granted by the parent company for 2023.

In 2020, Unilever Overseas Holdings BV acquired GlaxoSmithKline Bangladesh Ltd's health food and drinks portfolio, which includes popular brands like Horlicks and Boost.

Unilever acquired 98.75 lakh shares from Setfirst Ltd, a sister concern of GSK, at a price of Tk2,046.3 per share, resulting in a total transaction value of Tk2,020.75 crore.

As a result of this acquisition, GlaxoSmithKline Bangladesh Ltd was converted into Unilever Consumer Care.

Source: The Business Standard