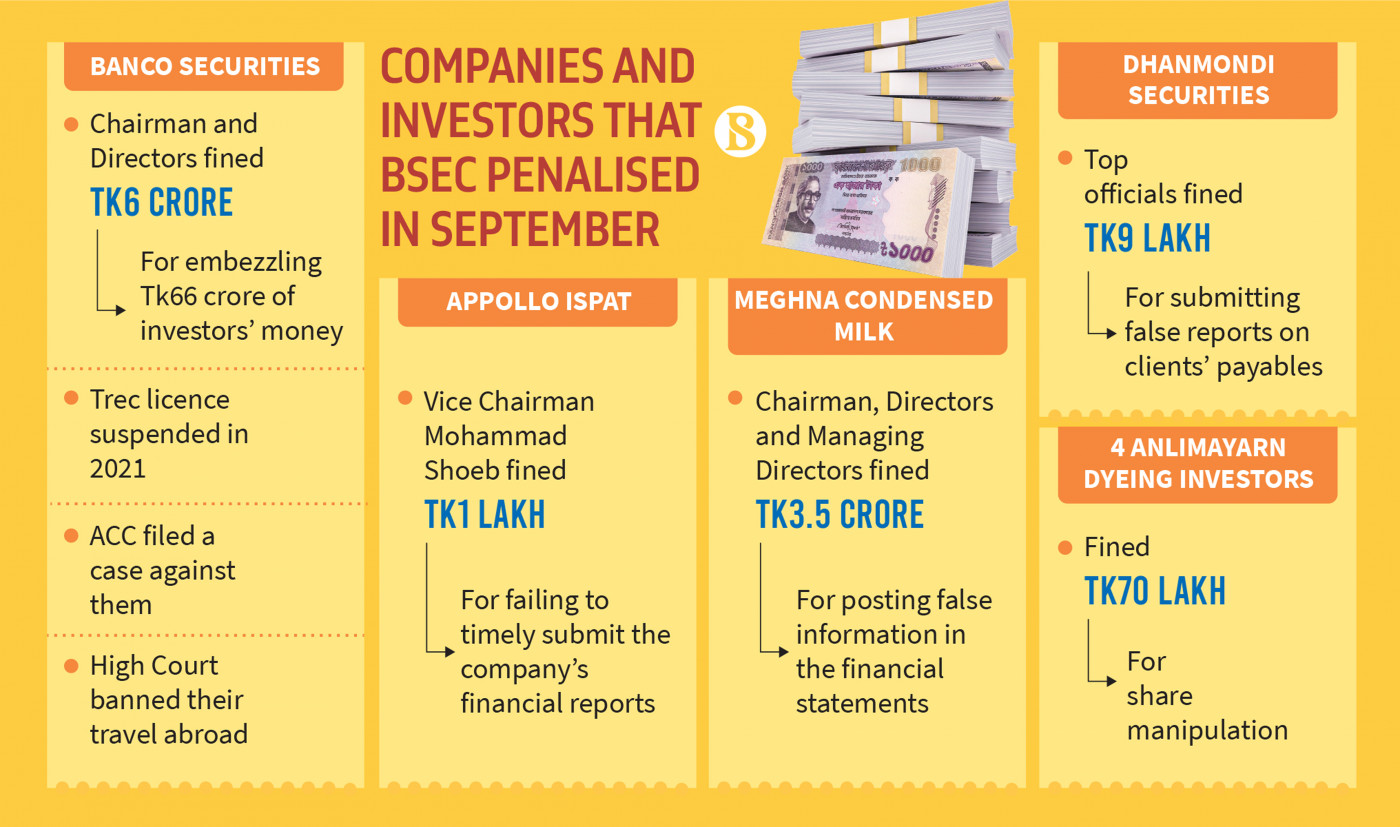

The stock market regulator has imposed fines totalling Tk10.30 crore on 12 owners of two companies, one brokerage firm, three of its officials, and four investors for their violations of securities rules.

The Bangladesh Securities and Exchange Commission (BSEC) took punitive action in September this year.

As per a report from BSEC, the chairman and five directors of Banco Securities were each fined Tk1 crore. The vice chairman of Appollo Ispat received a fine of Tk1 lakh, while the chairman and managing director of Meghna Condensed Milk were each fined Tk1 crore, and three of their directors were fined Tk50 lakh each.

In addition, Dhanmondi Securities was fined Tk5 lakh, and its former chief executive officer received a fine of Tk2 lakh. The head of finance and accounts, along with the IT in-charge, were fined Tk1 lakh each. Investor Shifat Mahmood Abdullah was penalised with a fine of Tk35 lakh, KTS Fashions with Tk10 lakh, Shahanara Akhter Chowdhury with Tk5 lakh, and Abul Kashem Bhuiyan with Tk20 lakh.

A top BSEC official said the Banco Securities owner got punished for embezzling Tk66 crore of investors' money, Appollo Ispat for non-submission of financial report in due time, and Meghna Condensed Milk people were fined for hiding price-sensitive information and giving false statements in the financial reports.

He added that Dhanmondi Securities provided the false information about investors' payable amount and its official did not provide data required by the BSEC inquiry committee. So, the commission fined the firm and its three top officials.

The four investors were punished for violating rules by manipulating Anlimayarn Dyeing shares.

As per the BSEC report, Banco Securities owners took investor funds under the credit facilities, violating the depository rules. Even so, they did not refund the money.

The BSEC summoned them to know their version of the accusation, but they did not respond.

Earlier, the Dhaka Stock Exchange (DSE) suspended the trade of Banco Securities over the embezzlement.

The High Court has barred Abdul Muhit, chairman of Banco Securities, from travelling abroad in a case filed by general investors for embezzlement.

Meanwhile, the BSEC report said the four investors, who traded shares through MTB Securities as their BO accounts opened in this firm, are family members and KTS Fashions related to them.

They jointly traded 36.20% shares of Anlimayarn Dyeing during 28 July 2021 to 1 September 2021 when they influenced the share price of the company, resulting in an increase of 20.94% through serial trading and gaining Tk2.58 crore.

Besides, the inquiry committee of the BSEC found that the production of Meghna Condensed Milk has been suspended since October 2019, but the company did not disclose it as price-sensitive information.

The company also provided misleading information about the value of property, plants, equipment, and inventories. They even violated rules to provide unsecured loans to its sister concern Meghna PET despite their worsening financial condition.

Meghna Condensed Milk did not provide the supporting documents to calculate the loan liabilities from Sonali Bank.

Source: The Business Standard

Note: This email is for research and analysis purposes only.