The Dhaka Stock Exchange (DSE) saw a slight rise in its indices on Monday (15 July) after three consecutive sessions of decline, as investors took the chance to book profits.

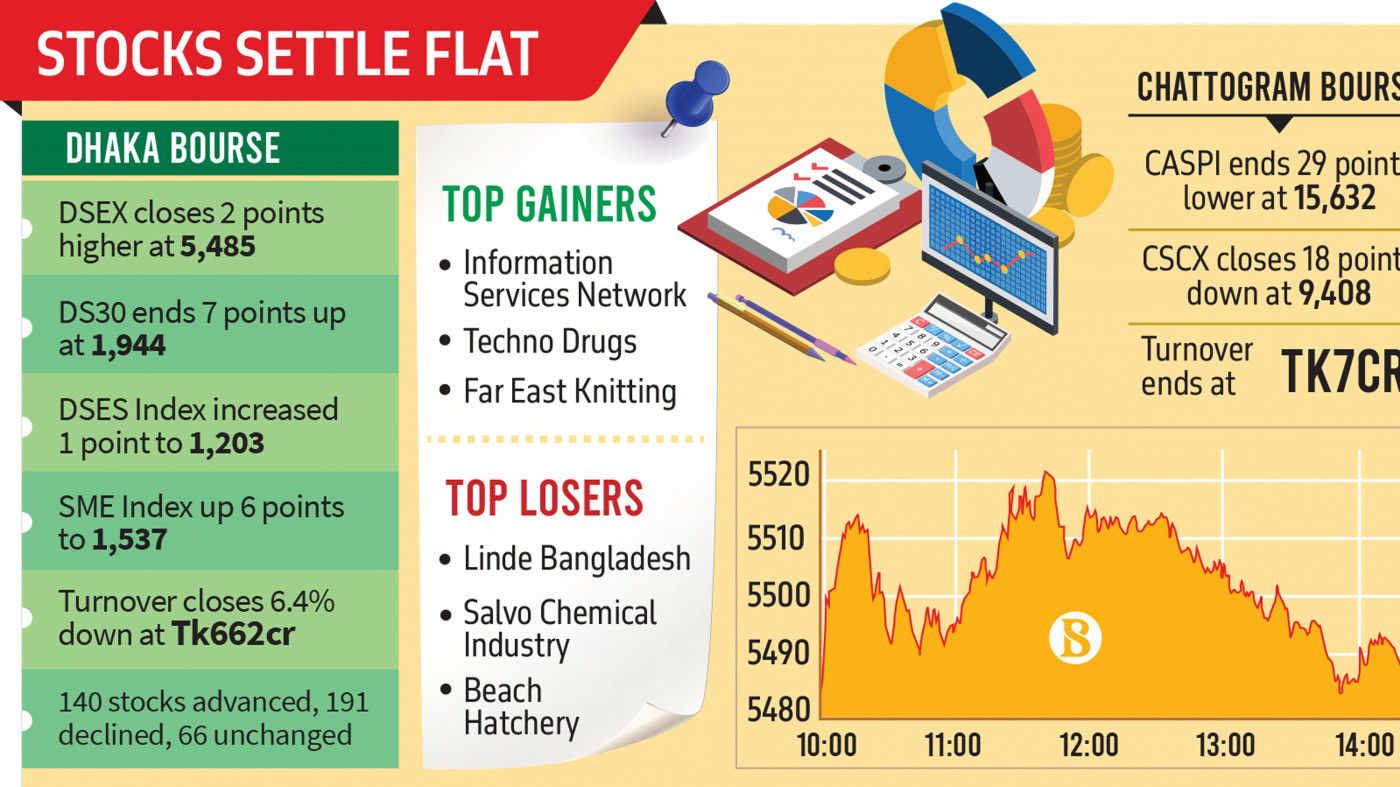

The prime index DSEX of the Dhaka Stock Exchange gained 2 points, closing at 5,485. The Blue-chip index DS30 increased by 7 points, reaching 1,944 points, and the Shariah-compliant stock index DSES went up by 1 point to 1,203 points.

As a result, turnover showed a slight increase of 5.1% on Monday, rising to Tk662 crore from Tk622 crore in the previous session.

On this day, the indices of the Dhaka Stock Exchange (DSE) opened higher but maintained the upward trend for only 15 minutes. After an hour, the index briefly returned to positive territory but failed to sustain it for more than an hour. Despite this, the session ended with modest gains, resulting in a slight increase.

Among the traded scrips, 140 advanced, 191 declined, and 66 remained unchanged during the trading session.

Market insiders stated that many blue-chip stocks have become attractive due to the recent bearish trend. They believe it is an ideal time to invest in specific, undervalued stocks.

Information Services Network topped the list of gainers, increasing by 9.93% to Tk49.80, followed by Techno Drugs at 9.85%, Far East Knitting at 7.81%, Walton Hi-Tech Industries at 7.49%, and Orion Infusion at 7.07%.

Linde Bangladesh topped the list of losers, followed by Salvo Chemical Industry, Beach Hatchery, Oimex Electrode, Khan Brothers PP Woven Bag Industries Ltd.

Orion Infusion, Sea Pearl Beach Resort & Spa, Taufika Foods and Lovello Ice-cream, Eastern Bank, Far East Knitting, and Salvo Chemical Industry were the most traded stocks on the Dhaka bourse.

EBL Securities wrote in its daily market commentary that the benchmark index of the Dhaka bourse ended on a flat note, managing to stay afloat in green territory after three consecutive sessions of correction since opportunistic investors sought bargain-hunting opportunities in sector-specific issues while the overall market sentiment remained subdued.

The market witnessed mild volatility throughout the session as investors remained active on both sides of the trading fence. Cautious investors remained observant of the market's trend ahead of the announcement of the upcoming monetary policy statement, according to the commentary.

On the sectoral front, pharma led with 27.4% turnover, followed by food at 11.2% and textiles at 9.0%.

Most of the sectors displayed mixed returns, out of which engineering 3.8%, cement 1.0% and life insurance 0.4% exhibited positive returns on the bourse on Monday, while jute 1.9%, travel 1.5% and mutual fund 1.1% exerted the most corrections.

The port city bourse, CSE, however, settled on red terrain. The CSE Selected Categories Index (CSCX) and CSE All Share Price Index (CASPI) declined by 17.7 and 29.0 points, respectively.

The bourse turnover stood at Tk7 crore at the end of the session. Out of the 246 issues traded, 75 advanced, 143 declined, and 28 remained unchanged.

On Monday, the DSE SME index increased 6 points to settle at 1,537. The turnover of the board stood at Tk26 crore at the end of the session.

Source: The Business Standard