Doreen Power Generations and Systems saw its lowest profit in seven years as the sharp devaluation of local currency against the US dollar squeezed margins.

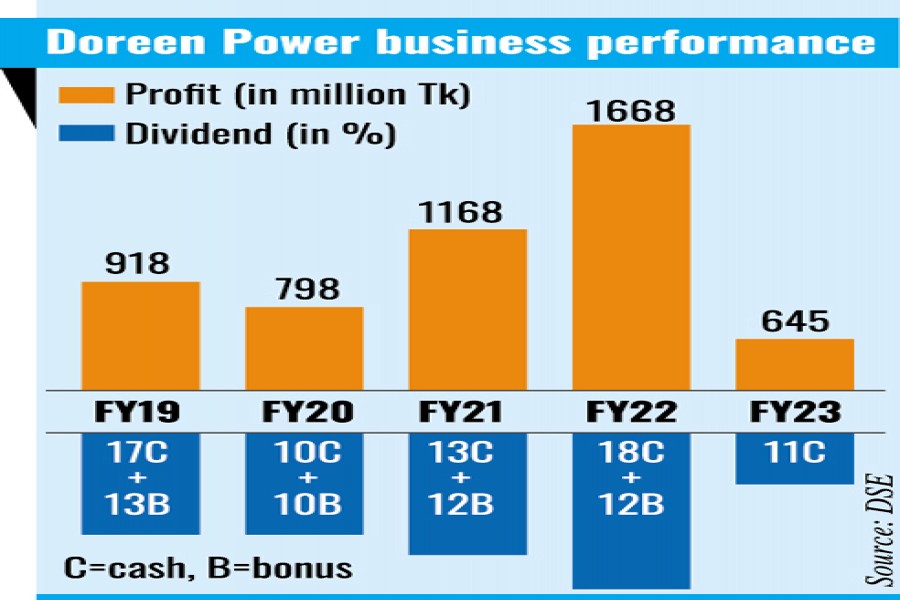

The power generation company made a consolidated profit of Tk 645 million in FY23, the lowest level since FY17 when it made a Tk 727 million profit.

However, Doreen Power's consolidated profit was Tk 1668 million in FY22.

Consequently, earnings per share (EPS) of the company slid to Tk 3.56 in FY23, as against Tk 9.21 in the year before, according to a disclosure published on Thursday.

The profit declined drastically due to a significant increase in the exchange loss in foreign currency transactions, incurred by its subsidiary companies, the company said in its earnings note.

Doreen Power has three subsidiaries -- Dhaka Southern Power Generations, Dhaka Northern Power Generations and Chandpur Power Generations.

Company Secretary Muhammad Amzad Shakil could not be reached for comments despite repeated calls.

Most businesses, particularly import-dependent companies, have been going through challenges due to the currency devaluation since the beginning of the Russia-Ukraine war in February last year.

Due to the stronger dollar, the cost of imports and repayment of foreign loans soared. The US dollar has appreciated more than 25 per cent against the taka since February last year.

The power generation companies have been hit hard as heavy fuel oil (HFO), the fuel used to generate electricity, became costlier in recent quarters, which ultimately raised their import costs, industry insiders say.

Due to a profit slump, the board of the company declared a 11 per cent cash dividend for FY23 only for general shareholders, excluding the sponsor-directors.

The sponsor-directors hold 120.64 million shares in the company out of total 181.12 million shares. As a result, the general shareholders will get cash dividend worth Tk 66.53 million, the company said in its earnings note.

The annual general meeting (AGM) will be held on December 7 on a digital platform. The record date has been fixed on November 9.

The company's consolidated net operating cash flow per share stood at Tk 17.98 in the FY23, as against Tk 28.77 in the negative for the previous year.

The company said net operating cash flow rose remarkably because of significant recovery of receivables from Bangladesh Power Development Board (BPDB) and a decrease in payment to suppliers.

Listed in 2016, Doreen Power's stock has been stuck at the floor price of Tk 61 each share since November last year.

Incorporated in 2007, the principal activity of Doreen Power is to set up power plants for generation and supply of electricity to BPDB and Bangladesh Rural Electrification Board (BREB) as per power phrase agreement.

Source: The Financial Express

Note: This email is for research and analysis purposes only.