STOCKS | PSI

Is Mithun Knitting moving towards delisting?

DSE fails in Islami Commercial Insurance debut

BSEC allows Coppertech to pay stock dividend

Index Agro to expand capacity to meet higher demand

Index Agro to expand capacity to meet higher demand

Index Agro Industries - a manufacturer of poultry, fish and cattle feed - has decided to invest Tk 140 million to enhance its raw material storage capacity in the feed mills division at Valuka in Mymensingh. "The management has decided to expand its raw material storage capacity by installing 2 silos with the size of...

https://thefinancialexpress.com.bd/stock/index-agro-to-expand-capacity-to-meet-higher-demand-1670900731

Economy

Foreign currency transactions through card rise 172% YoY in Jan-Oct

December 14, 2022

· Foreign currency transactions through cards maintained an upward trend in January-October this year, surging 172% year-on-year to BDT 3,908 crore, amid a crunch of cash dollars.

· Cardholders transacted a record BDT 605 crore in October, according to central bank data released Tuesday, up from BDT 586 crore in September.

· In the first ten months last year, foreign currency transactions through cards stood at BDT 1,434 crore, according to the Bangladesh Bank. This means, the cash dollar crunch drove up such transactions by BDT 2,471 crore in January-October this year.

· For dollar endorsement to cards, a number of banks were charging BDT 106-BDT 107 per dollar on Tuesday. However, the rate in the open market was BDT 112.

· Local transactions through card increased by 45% in January-October this year compared to the corresponding period last year. Cardholders spent BDT 37,530 crore for local transactions in October, show official data.

High cost of living takes a toll on bank deposits

December 14, 2022

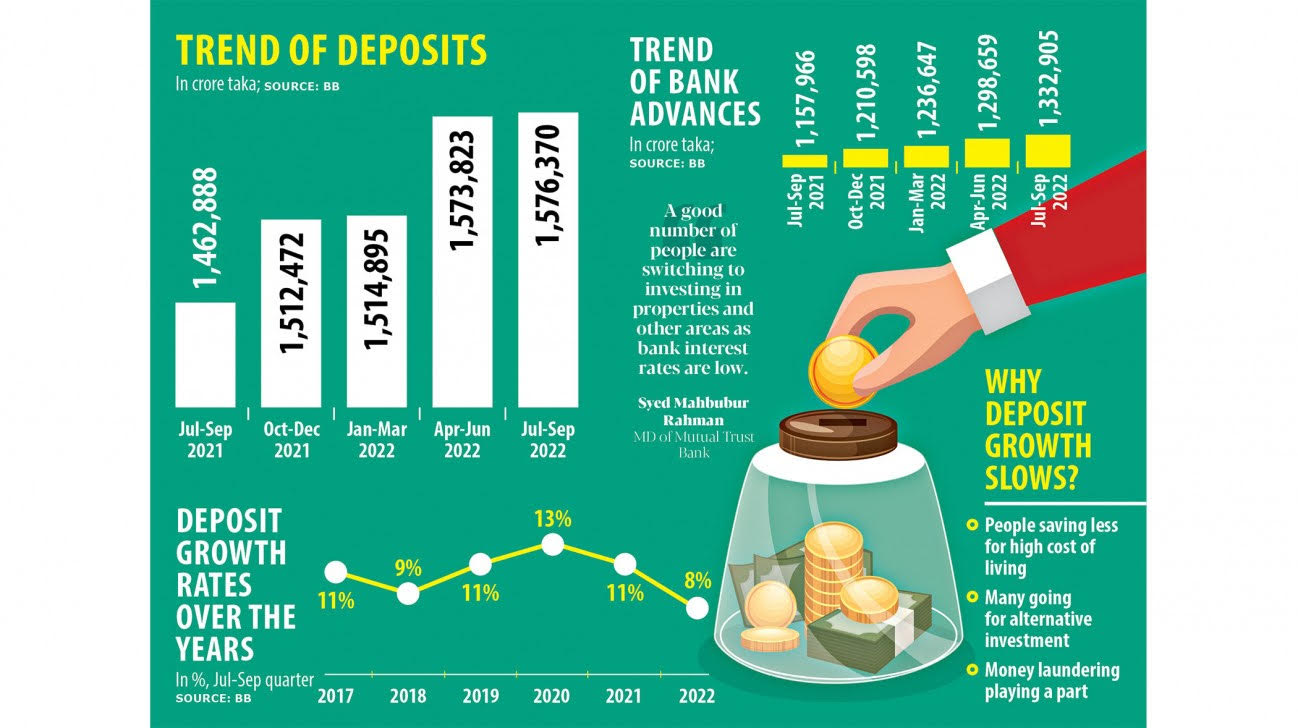

· The deposit growth in banks of Bangladesh has slowed as many people saw their capacity to save dwindle amid the higher cost of living.

· The deposit situation has aggravated further as a section of savers preferred to invest in alternative areas, namely property after they became frustrated by a very low-interest rate offered by banks and the withdrawal of savings by a section of people to cope with elevated inflation.

· The development is said to limit banks' capacity to lend and do business.

· Data released by the Bangladesh Bank showed that total deposits of the scheduled banks increased 8 per cent year-on-year to BDT 157,63,70 crore during the July-September quarter of 2022, the lowest deposit growth in five years.

· "The middle-income and fixed-income people are struggling owing to the higher inflation. Many families have had to withdraw their savings to cope with the higher consumer prices. It is also seen in the trend of sales of savings certificates," said Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), a think tank.

From: https://www.thedailystar.net/business/economy/news/bb-return-biannual-monetary-policy-3193741

Raw material import now troublesome

December 13, 2022

· The cement industry is facing trouble importing raw materials as the country's reserves of the US dollar was falling, according to Bangladesh Cement Manufacturers Association (BCMA).

· The main raw materials -- clinker, slag, limestone, fly ash and gypsum -- have to be imported, he said.

· Limestone can comprise a maximum of 35 per cent of the final product as per the Bangladesh Standards and Testing Institution and European norms and its import price is the lowest, he added.

· However, duty on it has been increased to 67 per cent of the import value from a previous 27 per cent and a 2 per cent advance income tax is levied at the sales stage as well, said Kabir.

From: https://www.thedailystar.net/business/economy/news/raw-material-import-now-troublesome-3195411

Banking

Short-term foreign loans allowed for import

December 12, 2022

· Businesses will be able to import eight essential items centring upcoming Ramadan by taking short-term loans from foreign sources, said Bangladesh Bank yesterday.

· This facility for edible oil, chickpea, pulse, pea, onion, spices, sugar and date will remain applicable till March 2023, according to a central bank notice.

· Importers will have to settle the letters of credit (LCs) within 90 days under supplier's and buyer's credit.

· A BB official said a majority of banks have been facing a shortage of dollars in recent months, which was why they were showing reluctance to open LCs for import, and the new facility would give respite to banks.

· The amount of foreign currencies held by the country’s commercial banks increased slightly by 4.5 per cent in November compared with that in the previous month amid various initiatives taken by the government to improve the situation.

· The gross foreign currency balance with the banks increased to $4,708 million in November from $4,505 billion in October, according to Bangladesh Bank data.

· Bankers, however, said that the rise was not enough to improve the ongoing dollar crisis on the financial market as the commercial banks continued struggling in settling import payment obligations due to the shortage of the greenback.

From: https://www.thedailystar.net/business/economy/news/short-term-foreign-loans-allowed-import-3195421

https://www.newagebd.net/article/189088/banks-foreign-currency-holding-edges-up-to-47b-in-nov

Excess liquidity at Islamic banks halves

December 14, 2022

· Excess liquidity at Islamic banks in Bangladesh fell nearly 50 per cent year-on-year to BDT 17,525 crore in July-September quarter this year as deposits growth slowed, central bank data showed.

· In July-September, overall deposits in Islamic banks, including the conventional banks that have shariah-based windows and branches, grew 11.9 per cent year-on-year to BDT 42,13,75 crore, the lowest growth in three years.

· The growth of deposits was only 2.1 per cent compared to the April-June quarter, according to the Bangladesh Bank's quarterly report, Developments of Islamic Banking System in Bangladesh, which was released on Monday.

· "The liquidity decline is the result of a slowdown in the deposit growth," said Shah Md Ahsan Habib, a professor of the Bangladesh Institute of Bank Management.

· Higher inflation and the lower interest rate on deposits are the prime reasons for the sluggish deposit growth.

From: https://www.thedailystar.net/business/economy/news/excess-liquidity-islamic-banks-halves-3195426

Capital Market

Another director to offload 1 lakh Walton shares

December 14, 2022

· To comply with the regulator's directive, another sponsor-director of Walton Hi-Tech Industries will sell 1 lakh shares as part of a move to increase its free float shares to 10% in the secondary market.

· As per disclosure at the Dhaka Stock Exchange (DSE) on Wednesday, SM Mahbubul Alam, who holds 5.40 crore shares of the company, wants to offload the shares at the prevailing market price within the next 30 working days.

From: https://www.tbsnews.net/economy/stocks/another-director-offload-1-lakh-walton-shares-551666

note: this post is for research and analysis only