The Chittagong Stock Exchange (CSE) has outlined a wish list for the upcoming national budget, urging the government to priorities the development of a robust capital market in Bangladesh.

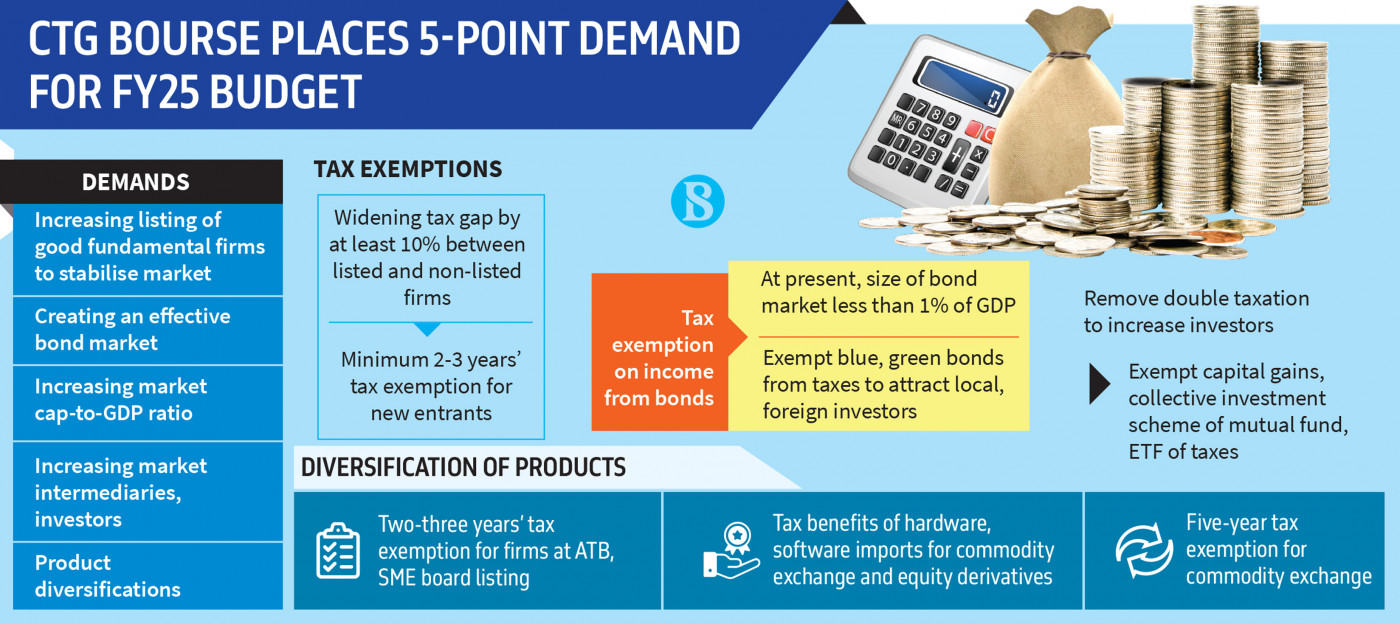

The CSE's demands include the removal of tax on capital gains, an increase in the number of listed companies, the establishment of an effective bond market, and the diversification of products within the capital market.

During a pre-budget press conference held at the CSE's headquarters in Chittagong on Sunday (2 June), CSE Chairman Asif Ibrahim stressed the importance of formulating appropriate strategies and expansion plans for the qualitative growth and sustainable development of the capital market.

The CSE hosted the press conference to share its demands with the National Board of Revenue (NBR), aiming to incorporate specific strategies into the budget structure. These demands had already been submitted by the CSE to the NBR.

During the conference, CSE Managing Director Md Shaifur Rahman Mazumdar addressed inquiries from journalists, with the event moderated by CSE Director Emdadul Islam. Notable attendees included CSE Independent Directors Mohammad Naquib Uddin Khan and Mohammed Akther Parvez.

Additionally, on May 28, the Dhaka Stock Exchange conducted a pre-budget press conference, proposing various measures such as exempting capital gains tax and adjusting tax discrepancies between listed and unlisted companies.

Asif Ibrahim pointed out the lack of incentives for small investors in the budget, highlighting that the current number of investors in the capital market falls below 1% of Bangladesh's total population.

He stressed the importance of devising a suitable strategy to enhance the quality and sustainability of the capital market, with the aim of boosting investor participation to desired levels.

The CSE chairman urged attention to various issues in setting short and medium-term goals for capital market development.

These goals include augmenting the number of listed companies, establishing an effective corporate bond market, improving the market cap to GDP ratio, enhancing the presence of market intermediaries and investors, and broadening the range of capital market products.

The CSE chairman highlighted that currently, there are 349 companies listed on the stock market. To ensure a stable capital market, it is crucial to increase this number by adding quality companies over the next five years.

To attract more investors, it is essential to eliminate the double tax on dividends, abolish the tax on capital gains for institutional investors, and enhance tax benefits for collective investment schemes like mutual funds and Exchange-Traded Funds.

To augment the quantity of quality listed companies, the press conference recommended increasing the disparity in corporate tax rates between listed and unlisted firms by at least 10%, along with providing tax exemption to newly listed companies for 2 or 3 years.

Asif Ibrahim suggested that tax breaks for blue and green bonds, including full tax exemption, could significantly boost marine-based investments in Bangladesh, appealing to both domestic and foreign institutional investors.

He proposed offering a tax exemption for the first 2 to 3 years for listings on the Alternative Trading Board and the Stock Exchange of Bangladesh (DSE) to promote product diversification.

Additionally, full tax exemption on hardware and software investments for launching commodity and equity derivatives should be provided. Furthermore, a five-year tax exemption should be granted to the commodity exchange to facilitate its establishment.

The press conference highlighted the necessity of a coordinated system involving the money market, capital market, and other relevant structures for a sustainable market. However, our financial system heavily relies on the banking sector, which poses various negative effects on our economy.

In response to journalists' queries, CSE Managing Director Md Shaifur Rahman Mazumdar pointed out the country's corporate financing dependency on the banking system, leading to a mismatch. To reduce this dependency, he emphasised the importance of building a robust market infrastructure.

Shaifur Rahman added that the current reliance on the equity market causes unwanted market volatility and hampers its expansion. Thus, effective strategies are crucial to address these issues.

Source: The Business Standard