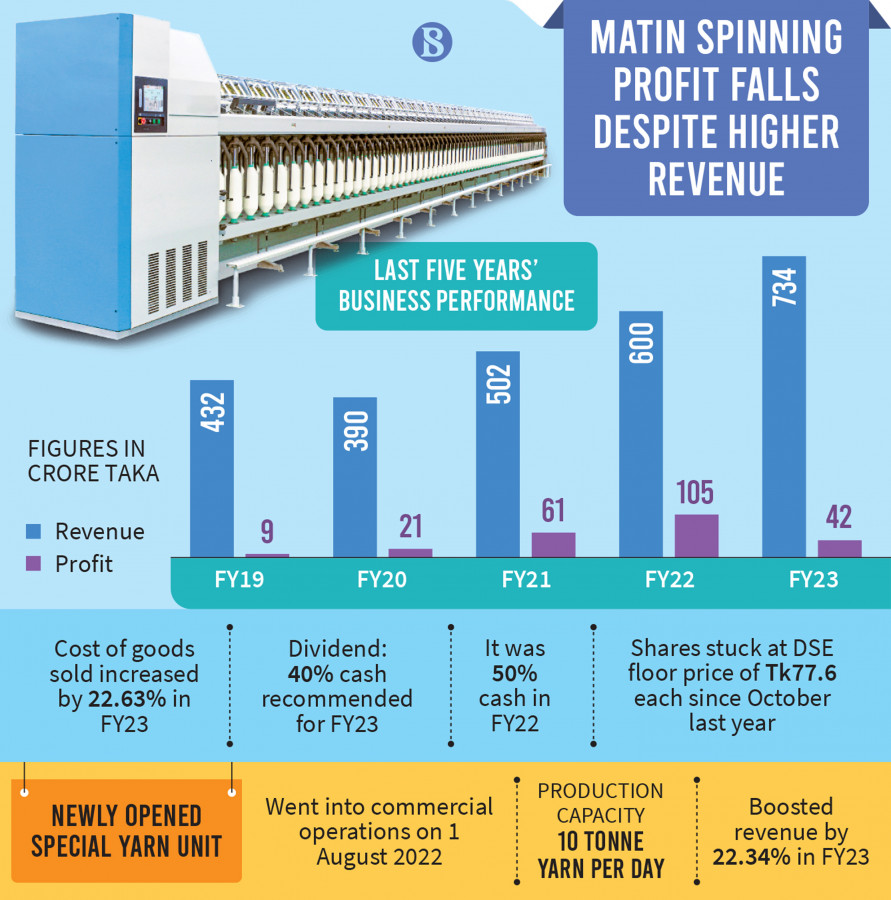

Matin Spinning Mills' year-on-year profit for fiscal 2022-23 declined by 59% to Tk42.71 crore due to cheaper yarn and the rising costs caused by the appreciation of the dollar against the taka.

According to a senior officer of the company, the reduced demand forced the company to sell yarn made from cotton purchased at higher prices at lower rates.

"We had to purchase cotton at high prices, but yarn prices did not increase in line with the elevated production costs. Consequently, our earnings were lower than the previous year," MA Jabbar, managing director of DBL Group, told The Business Standard.

"On the other hand, the sluggish global demand for apparel has also impacted our business," he explained, noting that cotton prices are still high.

However, the DBL Group concern secured a record revenue of Tk734.39 crore in FY23, with a 22% growth compared to the previous fiscal year driven by the newly opened special yarn unit.

Meanwhile, despite the decline in profit, Matin Spinning board decided to pay 91% of its profit in cash, which means shareholders will get Tk4 for each share as a dividend for the last fiscal year.

To approve the dividend, the company will conduct the annual general meeting on 30 November and the record date is 7 November.

Why profit declined

In a price-sensitive statement, Matin Spinning mentioned that in the last fiscal year, the cost of goods sold increased by 22.63% compared to the previous year.

It stated that the business costs for spinning mills increased significantly due to rising expenses in raw materials, power, fuel, and finance.

Besides, it had to sell the yarn at a 12.09% lower price per kg than the previous fiscal year. These were the main reasons behind declining profits.

As an exporter, it could not realise the foreign exchange gain as it has to import cotton at a high price due to the dollar's appreciation against the local currency.

In the beginning of 2022, spinners could buy a US dollar for Tk83-Tk85. Now, the same American greenback is costing them over Tk110.

According to the Bangladesh Textile Mills Association, although cotton prices have declined sharply in international markets, spinners could not avail themselves of the benefit due to the dearer US dollar, the energy crisis, and the fall in demand for finished goods.

Besides, orders were also slowed down by international buyers due to deep inflationary pressures caused by the Russia-Ukraine war.

In addition, spinners are sitting on piles of unsold yarn made from cotton imported earlier at a higher price. Due to this, they sold their goods at a discount rate.

During peak times, local spinners can sell 1.20 crore kg of yarn a day to export-oriented garment factories alone. Owing to the lower demand, they can sell 80 lakh kg of yarn daily presently.

Record revenue

Matin Spinning earned Tk734 crore in the last fiscal year, which was the highest in its history.

Mainly, the new spinning unit helped the company achieve record revenue.

The unit started operation on 1 August last year. Its production capacity is 10 tonnes of yarn per day. At present, Matin Spinning's total daily production capacity is 61 tonnes.

To complete the new unit, it has invested Tk186 crore, Tk61 crore came from its own sources, and Tk125 crore from the German Investment Corporation DEG.

Matin Spinning shares have been stuck on the floor price at Tk77.60 since October last year at the Dhaka Stock Exchange.

Source: The Business Standard

Note: This email is for research and analysis purposes only.