The securities regulator has recently formed an inquiry committee to review all the portfolio statements of three mutual funds managed by Prime Finance Asset Management Company Limited.

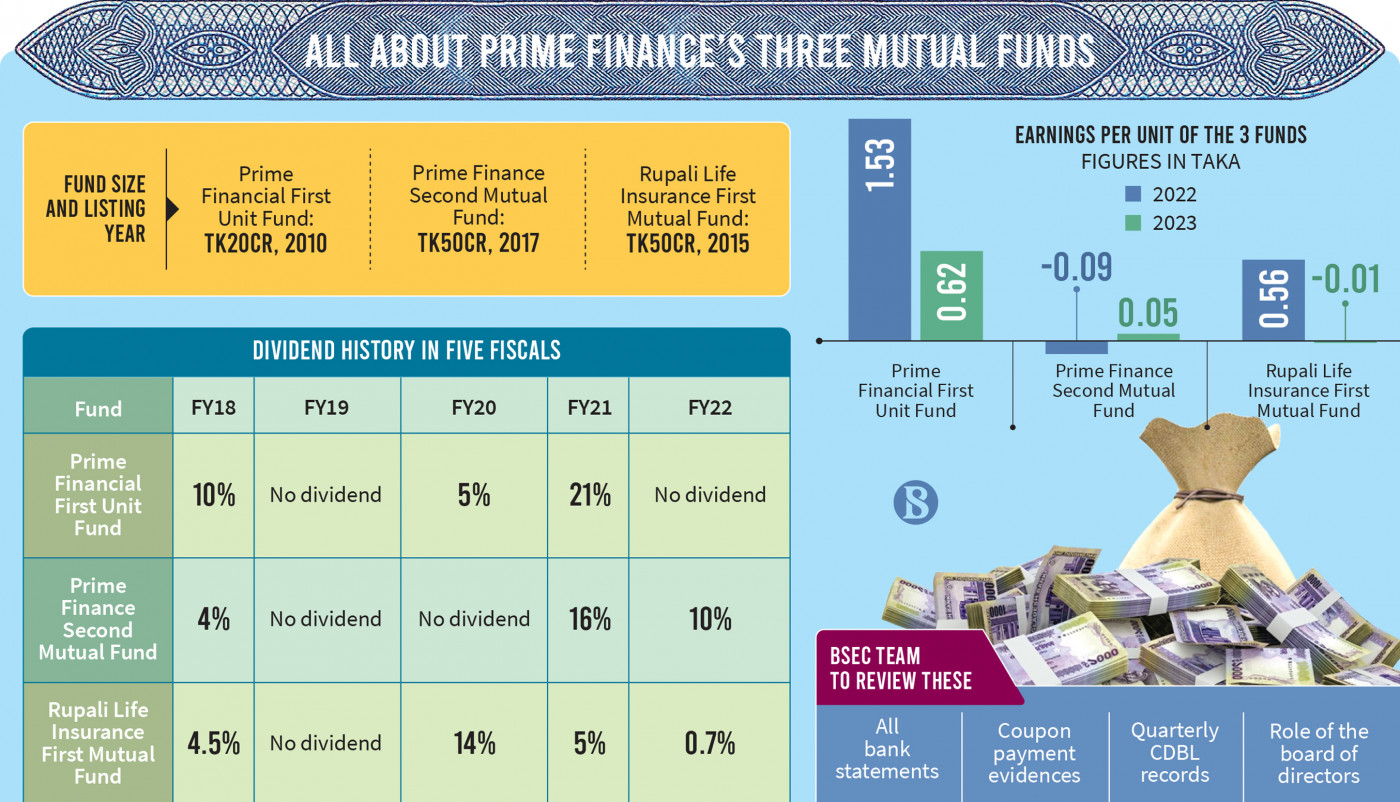

The funds in question are Prime Financial First Unit Fund, Prime Finance Second Mutual Fund, and Rupali Life Insurance First Mutual Fund.

Md Rafiqunnabi, deputy director at the Bangladesh Securities and Exchange Commission (BSEC), and Md Atiqullah Khan, assistant director at the commission are the committee members.

The two-member team has 30 working days from the date of issuance of the inquiry order to investigate and submit its findings to the BSEC.

BSEC Commissioner Dr Mizanur Rahman said the commission will decide on the next steps after receiving the report from the probe body.

The committee will look into the role of the board of directors and key management personnel of the asset management company in illegal embezzlement, misappropriation, and laundering of unit holders' money for their own benefits.

It will review all bank statements of the mutual funds and that of the asset management company from their inception to the present day.

Also, official transaction statements in beneficiary owner accounts of each mutual fund will be verified.

The team will review the evidence on coupon payments or interest payments on term deposits and other balances with banks and financial institutions.

It will also identify unlawful payments out of bank accounts of the mutual funds to the benefit of the asset management company and any related parties.

The inquiry committee will review the quarterly Central Depository of Bangladesh Limited (CDBL) records of investments in securities as reported in the balance sheets of the funds from their inception to the present date.

Besides, the team will examine overstatements of the funds' net asset values and ascertain overstatements of the operating expenses including management fees charged against the funds.

Details of the funds

Prime Financial First Unit Fund raised Tk20 crore in September 2010 from the capital market at a face value of Tk100 per unit. The fund's total investment in securities stood at Tk15.98 crore on 31 March this year.

At the end of March 2023, its earnings per unit stood at Tk0.62, which was Tk1.53 a year ago. The fund's trustee committee did not approve any dividend for FY22.

Prime Finance Second Mutual Fund raised Tk50 crore in February 2017 at a face value of Tk10. Its total investment in securities stood at Tk19.10 crore at the end of March 2023.

On 31 March, its earnings per unit stood at Tk0.05, which was a loss of Tk0.09 in 2022. The fund's trustee committee approved a 10% cash dividend for the unitholders in FY22.

Rupali Life Insurance First Mutual Fund raised Tk50 crore in February 2015 at a face value of Tk10. Total investment in securities as of 31 March 2023 stood at Tk27.56 crore.

Its loss per unit stood at Tk0.01 at the end of March this year, which was Tk0.56 last year. In FY22, the trustee committee approved a 0.7% cash dividend for the fund's unitholders.

Why the probe

Earlier, after a report that said UFS Asset Management had embezzled Tk158 crore from investors' funds, the BSEC formed an inquiry committee to investigate the matter.

Syed Hamza Alamgir, managing director of UFS Asset, embezzled the money by showing false reports of assets and fled the country.

Following this incident, the BSEC decided to inspect other asset managers.

There are various allegations about mutual fund misappropriation through unit sales and a lack of good governance and transparency which created mistrust among shareholders of mutual funds.

This January, the BSEC formed three separate committees to inspect assets of Race Asset Management, LR Global Bangladesh, and ICB Asset Management.

Source: The Business Standard

Note: This email is for research and analysis purposes only.